The FMBN MD said the bank has refunded N66. 678 billion to 444,637, while N347. 570 billion was invested in various projects financed by the Bank.

The House of Representatives has summoned the Accountant General of the Federation (AGF) to appear before it to explain the disparities in the deductions from workers for the National Housing Fund Scheme, and give reasons why only N20 billion has been remitted to the Federal Mortgage Bank since 2011 to date.

The House Ad-hoc Committee investigating the non-remittances of funds to the National Housing Fund (NHF) and non-utilization of the funds expressed concern about why monies deducted from workers’ salaries are not remitted to the fund as stipulated.

Earlier, the representative of the Director of the integrated Personnel Payroll and Information System (IPPIS), Ekwem Dem, told the Committee that, while deductions from the salaries of workers were automatic, remittances were not automated.

He, however, could not tell the Committee how much has been deducted as housing fund from workers since 2011 saying even though they have the information, he needs to “query the system” before responding to the question.”

READ ALSO: Lagos Assembly rejects ‘COVID Response’ Commissioner, 16 Others as cabinet-nominees

Members of the House Committee took turns to query the documents presented to it by the Integrated Personnel Payroll and Information System that showed that N23,000 was deducted from the University of Calabar for NHF for one month, while Federal Polytechnic, Birnin Kebbi contributed N9,000 only, as captured in the document submitted to it.

The lawmakers asked the Accountant General to furnish the Committee with information on what has been deducted from workers so far, when such money was deducted, and why the money has not been remitted.

A member of the Committee, Rep Timehin Adelegbe (APC, Ondo), who frowned at the deductions insisted that remittances to NHF are supposed to be automatic hence, deductions are also instant. “If the deduction is automated, the remittances should also be automated.”

The Committee also asked the Accountant General to remit all deductions of the Housing fund remitted to the federal Mortgage Bank with immediate effect and receipt presented to the committee.

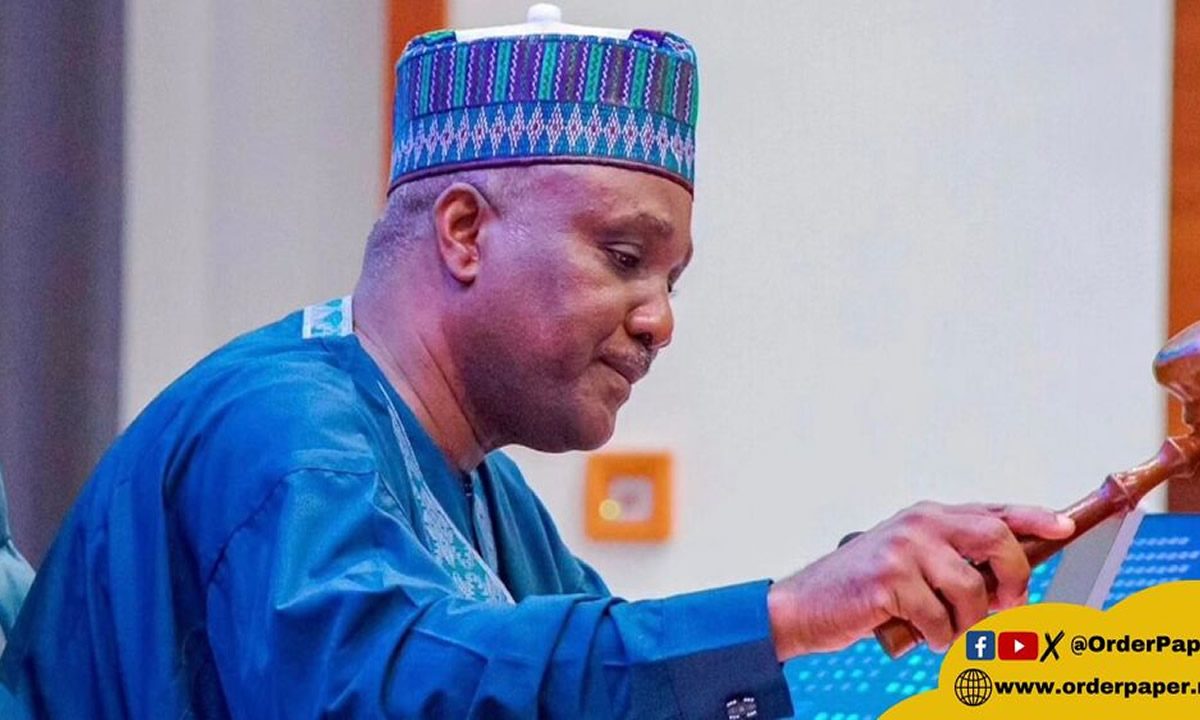

The Managing Director of the Federal Mortgage Bank of Nigeria (FMBN), Madu Hamman, appealed to the Committee to amend the Act establishing the Bank and the National Housing Fund to give more effect to the operation of the NHF.

Hamman informed that so far, the Bank collected about N591. 523 billion as remittances from both the formal and informal sectors since 2011 till date, out of which N238. 557 billion was collected from government Ministries, Departments, and Agencies.

He also noted that the bank had an outstanding payment of about N26. 573 billion with the office of the Accountant General of the Federation, adding that the Accountant General erroneously deducted about N11.6 billion from remittances of workers between October and December 2022 as part of government revenue, mistaking the remittances to be revenue coming into the bank.

“We had to explain to them that the money was remittances of workers contributions to the NHF before the deduction was stopped through Treasury Single Account.

“Between January 2022 and December 2022, the IPPIS failed to remit about N11. 587 billion deducted from workers’ salaries and another N3.356 billion between April and July 2021.

Hamman equally disclosed that contributors to the NHF are eligible for a full refund of their contributions over the years with accrued interest of 2 percent upon retirement after attaining the age of 60 or inability to continue contributions due to incapacitation or death.

According to him, the Bank has so far refunded N66. 678 billion to 444,637, adding that out of the N591.523 billion collected for the Nation Housing Fund within the period, about N347. 570 billion was invested in various projects financed by the Bank.

“These projects include Cooperative Housing Development Loan (N44.019 billion), NHF Mortgage loan (N139.095 billion), Ministerial Pilot Housing Scheme (N38.037 billion), TUC/NLC/NECA housing scheme (31.659 billion), Individual construction loan (N269.044 million), Home Renovation Loan (N92.468 billion) and Rent to Own (N2.021 billion).”

The FMBB boss further listed some of the major challenges, which include over-concentration of Primary Mortgage Banks in Lagos and Abuja, while none exist in most states of the Federation.

He also said the contradictions between the FMBN Act and the CBN prudent guideline on single obligation limits for PMBs is affecting loan disbursement as well as lack of loan affordability by majority of contributors as a result of low income.