The current fiscal policy and debt servicing mechanisms need serious and urgent attention and inclusion to boost the steps taken by the MPC.

Fiscal reforms have been a recurring call by many experts and stakeholders, as the ripple effects of the nation’s fiscal policy are becoming evident in the socioeconomic challenges being witnessed.

In a recent development, the Central Bank of Nigeria (CBN), through its Monetary Policy Committee (MPC), to stimulate growth, took steps to address Nigeria’s economic woes during its Monetary Policy Meeting on Tuesday, February 27.

Some of these steps include the removal of fuel subsidies; FX unification into a single investor and exporter (I&E) window; raising the Monetary Policy Rate (MPR) by 25 basis points to 18.75%; the Inauguration of the Presidential Committee on Fiscal Policy and Tax Reforms; Presidential-approved interventions: cash transfer program, food grants, land and fertiliser support; a switch to CNG vehicles; and, the decision to float the naira, amongst other steps.

Governor Yemi Cardoso, who presided over the MPC meeting, revealed the unanimous decision of all 12 committee members to tighten monetary policy. This move comes against the backdrop of the continued fluctuation of the naira against the USD and the prevailing economic hardships in Nigeria.

He said, “All 12 members of the committee decided to further tighten monetary policy by raising the MPR by 400 basis points to 22.75 per cent from 18.75 per cent. Adjust the asymmetric corridor around the MPR to +100 to -700 from plus 100 to -300 basis points. The members of the committee arrived at a reasonable consideration to tackle inflation and a targeting framework as essential to addressing the persistence of inflationary pressures in the economy.”

In the opinion of the Committee, the options available for decision were to either hold or hike the policy rate to offset the persisting inflationary pressure. Considering the option of a hold policy, the evidence revealed that previous policy rate hikes have slowed the rise in inflationary pressure, but not to a desirable extent. Members considered various scenarios of hold and hike and concluded that inflation could become more persistent in the medium term and thus pose more regulatory challenges if not effectively anchored. The balance of the argument thus leaned convincingly in favour of a significant policy rate hike to drive down inflation substantially.

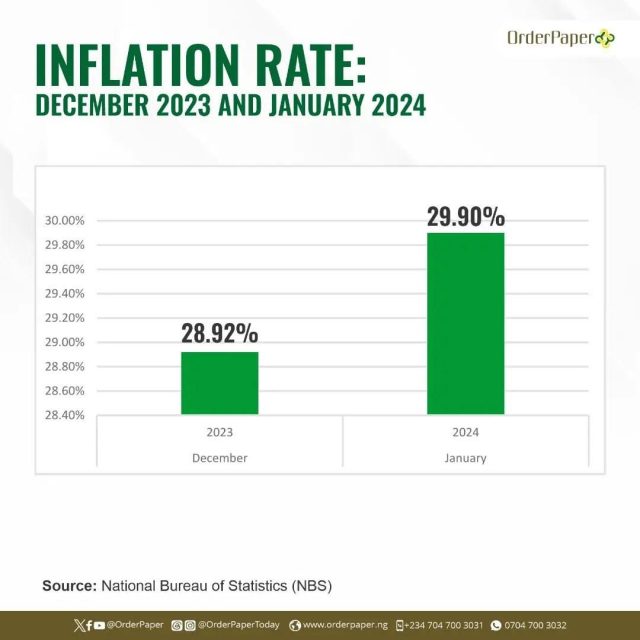

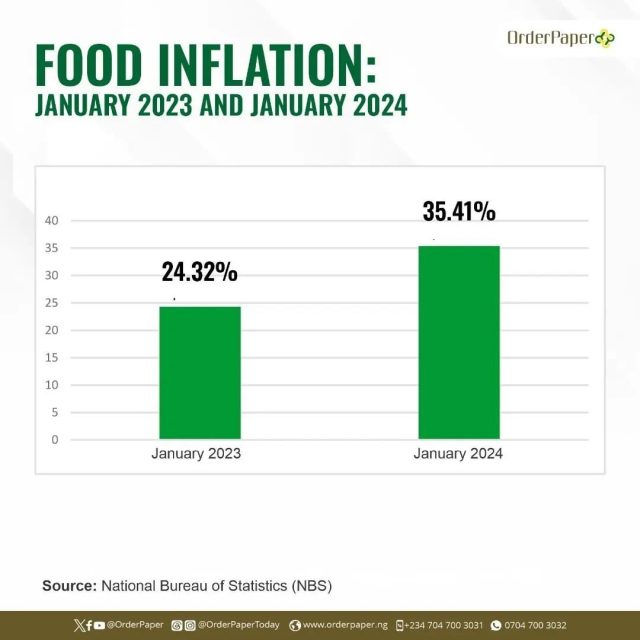

Data reveal that Nigeria’s headline inflation (year-on-year) rose to 29.90 per cent in January 2024 from 28.92 per cent in December 2023. Food inflation increased to 35.41 per cent from 33.93 per cent, while core inflation (Headline less farm produce and energy) rose to 23.59 per cent from 23.07 per cent.

The major factors driving inflationary pressure remain exchange rate pass-through, rising cost of energy, high fiscal deficits, and lingering security challenges in major food-producing areas. In addition, global factors such as tight financial conditions and trade disruptions from ongoing geopolitical tensions, remain significant upside risks to the outlook for domestic inflation. Experts indicate that inflation will remain on an upward trajectory in the near term before commencing a descent.

To proffer a solution to these issues, OrderPaper Advocacy Initiative, Nigeria’s foremost independent parliamentary monitoring organisation and policy think tank that bridges the gap between people and parliament, hosted a capacity-strengthening workshop for lawmakers on fiscal responsibility and public finance management under the GIFT project being implemented by OrderPaper alongside a cluster of civil society organisations – Centre for Transparency Advocacy (CTA), Hipcity Innovation Centre, CLICE Foundation and AdvoKC – with support from the United States Agency for International Development (USAID) under the Strengthening Civic Advocacy and Local Engagement (SCALE) Project by Palladium International.

Prof. Uche Uwaleke, Director, Institute of Capital Market Studies, Nasarawa State University, speaking at the workshop on Nigeria’s current economic crisis and the need for fiscal reforms, pointed out that “Nigeria stands at a critical juncture, facing complex economic challenges that threaten its future prosperity.”

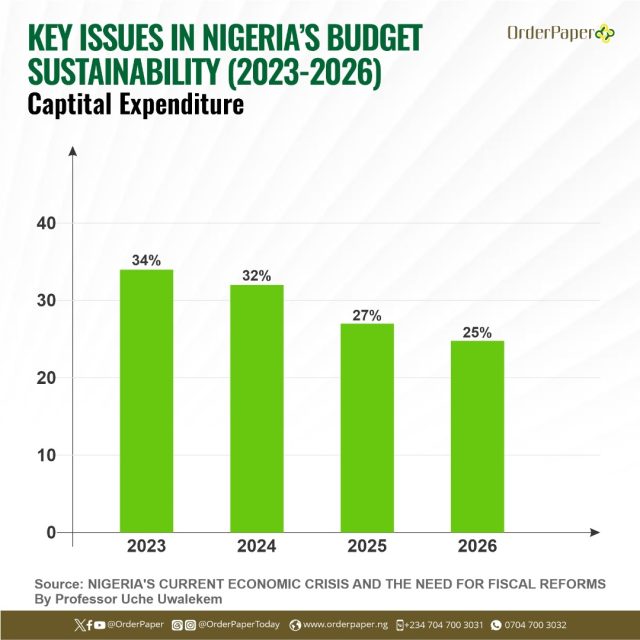

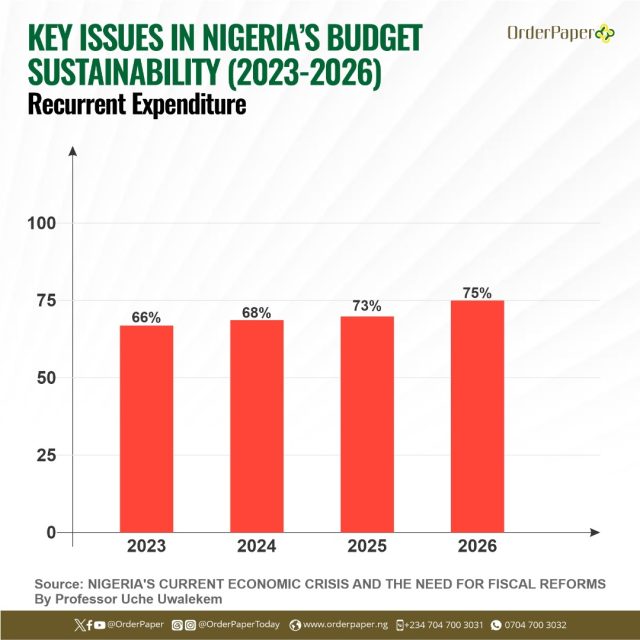

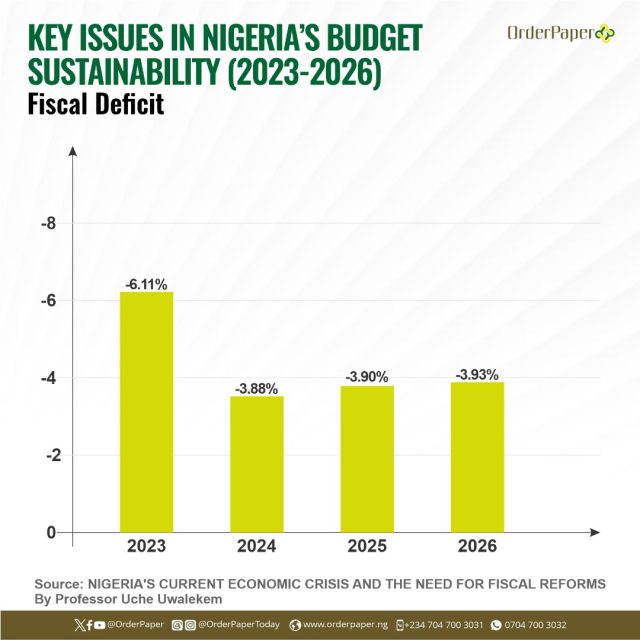

Analyzing key issues in Nigeria’s budget sustainability, Uwaleke said: “The fiscal deficit is increasing, the proportion of capital expenditure is declining, the proportion of recurrent expenditure is rising, and the consequences that have been the trend over the years include; increased debt burden, decaying infrastructure, slower economic growth, high unemployment, and the lack of management of resources for development.”

Consider the following snapshots of how projected Nigerian expenses exceed revenues: imports have exceeded exports and liabilities, which do not exceed our assets but are impacted by mismanagement of government funds, loopholes, abandoned projects totalling over 60,000, a high rate of corruption, and a lack of input on things that can improve production and skyrocket revenue generation.

Actual debt service costs have consistently exceeded budgeted figures, raising concerns about fiscal sustainability. As of September 30, 2023, the pro rata spending target for 2023 appropriation was N18.75, which is currently at 22.75.

Prof. Uwaleke further highlighted strategic solutions to the challenges of Fiscal Reforms.

He noted, “Implement fiscal consolidation: control government spending, prioritise critical expenditures, and gradually reduce budget deficits”.

“Consolidate all the pieces of legislation that regulate the budget process in a budget law: Plug loopholes in the current budgeting system and pay closer attention to implementation and control.”

“Improve debt management: Enhance transparency and accountability in debt management practices, ensuring responsible borrowing and efficient resource utilisation. On Low Tax revenue mobilization, it is hoped that the implementation of the recommendations by the Fiscal Policy and Tax Reforms Committee would address the pre-existing issues (narrow tax base, etc.) in the system.”.

“Strengthen public financial management (PFM) systems: conduct a review of the current systems (TSA, IPPIS, etc.) to plug identified loopholes.”

“Promote anti-corruption measures: enforce stricter regulations, strengthen oversight mechanisms, and foster a culture of integrity in public finance management.”

“Address underlying social and political issues: Tackling poverty, inequality, and insecurity can create a more conducive environment for successful fiscal reforms.”

“Invest in human capital: Developing a skilled and educated workforce is crucial for long-term economic growth and sustainable fiscal management.”

One thing is obvious the current fiscal policies and debt servicing mechanisms need serious and urgent attention and reform. Although the steps taken by the MPC might have positive effects on the economy, one thing is certain: Prof. Uwaleke’s recommendations deserve consideration for implementation if the nation is interested in solving its economic woes.

Published with additional reports by LEAH TWAKI and JOY ERURANE