By securitising ways and means, rather than paying back to the CBN, the Federal Government simply places too much money in the capital market, thereby creating the availability of more funds in the economy and fuelling inflation.

The 10th National Assembly is set to investigate the Ways and Means approved by the last government as it, on Tuesday, set up an ad hoc committee, chaired by Senator Jibrin Isah (APC, Kogi East), to probe the N30 trillion ‘Ways and Means’ which the Central Bank of Nigeria (CBN), released as loan to the Federal Government during the administration of former President Muhammadu Buhari.

OrderPaper recalls that the Senate last Tuesday, 21 February 2024 considered the report of its Joint Committee on Banking, Insurance and Other Financial Institutions, Finance, National Planning, Agriculture, and Appropriation, chaired by Senator Abdullahi Yahaya Abubakar (PDP, Kebbi North).

This however led to a heated debate between Senators. The Senate Whip, Senator Ali Ndume (APC, Borno South) accused the Senate of granting the request without seeking clarification from former President Buhari.

According to Ndume, the Senate had acted illegally by allowing funds drawn from CBN, and already expended to be brought to the parliament for approval citing relevant sections in the 1999 Constitution of the Federal Republic of Nigeria as amended, and accused the Senate of lacking powers to approve funds already spent.

READ ALSO: Senators trade words over N29 trillion Ways and Means funds

- Breakdown of the opaque approval process

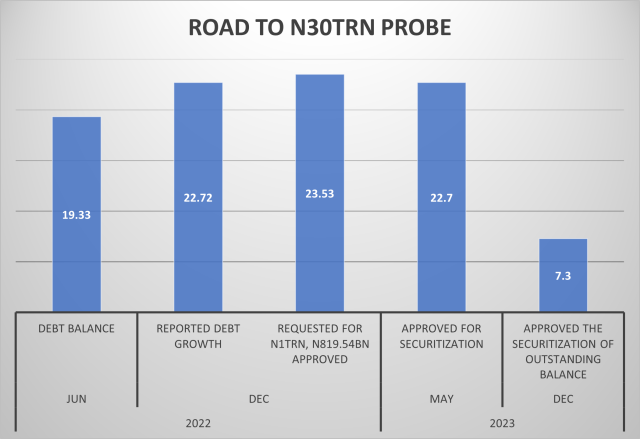

The 9th Senate had in May 2023, approved the request by former President Muhammadu Buhari on the N22.7tn Ways and Means which it had refused to approve in the previous year (2022), on grounds that it lacked details.

Buhari however, responded that if the request is not approved, the federal government would add N1.8 trillion interest in 2023.

- Lawmaker justifies the borrowing

The Senate Leader at the time, Ibrahim Gobir, who led the Senate in the debate for the approval of the Ways and Means explained that part of the money was given as loans to states.

He added that a Special Committee was set up by the Red Chamber to scrutinise the fiscal document and put up the report after critical analysis and review of submissions made by the Federal Ministry of Finance, Budget, and National Planning and the CBN.

According to Gobir, the panel found that the Ways and Means balance increased from N19.33 trillion on June 30, 2022, to N22.72 trillion on December 19, 2022, due to financial obligations to ongoing capital projects and additional expenses, including interest rate and gaps in domestic debt service.

He pointed out that the Senate had approved N819.54 billion of the N1 trillion additional request that the President had made on December 28, 2022; the N180.4 billion remaining was the amount that represented the accumulated interest on the amount.

On his part, Ahmad Lawan (APC, Yobe North) who was the Senate President at the time, said that the Senate had to pass the Ways and Means Advances so that the federal parliament would be able to consider and pass the 2022 Supplementary Budget still pending before the two chambers.

“I don’t see any National Assembly standing against any infrastructure development like the building of roads and bridges among others. It is therefore very important that before the executive incurs this kind of huge Ways and Means Advances, they should, as a matter of must, seek the approval of the National Assembly. Where for whatever reason, an emergency happened, it should not take them this kind of period before a request is sent to the National Assembly for approval.”

- Another opaque approval process and corruption allegation

Additionally, the 10th Senate, following the consideration of President Bola Tinubu’s request on December 30, 2023, approved the securitisation of the outstanding debit balance of N7.3 trillion of the Ways and Means Advance in the Consolidated Revenue Fund (CRF) of the Federal Government.

In a final panel report titled “Report of the Special Investigation on CBN and Related Entities (Chargeable Offences),” released on December 22, 2023, Jim Obazee, a special investigator investigating the CBN and related entities, revealed that after a five-month investigation, it found that the CBN had used Ways and Means advances “fraudulently” while Godwin Emefiele was in office.

Despite providing “a different figure to the National Assembly on the same date,” the panel claimed that Emefiele and former finance minister Zainab Ahmed had jointly signed a statement directing Buhari to restructure the ways and means of N23.71 trillion.

- What really is “Ways and Means?”

The phrase “Ways and Means” started a long time ago before anyone using it in Nigeria today.

It originated from the 17th-century British Parliament and was referred to as “the provision of revenue to meet national expenditure requirements.” The phrase was always used by Nigerian economists and finance experts to explain debt and inflation, but it became popular when former President Muhammadu Buhari’s administration began to see it as the last resort.

The “Ways and Means” is a kind of loan facility that the CBN uses to finance or cater for the federal government’s budget shortfalls or in times of emergency.

This means that the Ways and Means are loans that should be repaid. Section 38 (2) says “all advances made pursuant to this section shall be repaid as soon as possible,” and of course, with interest.

- The adverse effects on economic stability

Given the fact that Buhari securitised the Ways and Means the Federal government has been unable to repay the loan. This automatically explains one of the reasons for the increased inflation in the country.

By securitising ways and means, rather than paying back to the CBN, the Federal Government simply places too much money in the capital market, thereby creating the availability of more money in the economy and fuelling inflation.

Furthermore, because interest must be paid back on every loan taken out, it makes Nigeria’s debt servicing burden even worse. This leaves little money for development and infrastructure projects that will help the average person.

Talking about debt servicing, according to the Debt Management Office, the Nigerian total public debt portfolio as at September 30, 2023 is at N87.91 trillion or $114.35 billion, a staggering 90.08% rise as against N46.25 trillion or $103.11 billion in the fourth quarter of 2022.