While some agencies have defended their partnership agreements as necessary for attracting investment, the national assembly says the country is being cheated.

Nigeria has long grappled with the challenge of revenue mobilisation, a critical factor for achieving fiscal sustainability. Reports have it that critical agencies such as the Nigerian National Petroleum Company Limited (NNPCL), Nigerian Liquefied Natural Gas (NLNG), and Nigerian Immigration Services (NIS) engage in Public-Private-Partnerships (PPPs) and Joint Venture Agreements (JVAs) that disproportionately favor private entities over the government. These arrangements often involve revenue-sharing formulas and operational cost structures that significantly reduce remittances to the federation account.

It is in this regard that the national assembly through its joint committees on finance, national planning and economic affairs on the 2025-2027 Medium Term Expenditure Framework (MTEF) and Fiscal Strategy Paper last Monday strongly condemned the unjust PPP arrangement involving passport production by the Nigerian Immigration Service (NIS).

It criticised the agreement, which allocates 70 percent of proceeds to consultancy firms and only 30 percent to the government, thereby short-changing the country and its citizens.

One of the recommendations of the joint committees on finance, national planning, and economic development, is that the federal legislature should scrutinise these agreements to reconcile remittances to the federation account and address systemic issues hindering revenue growth.

Following on the steps of the House of Representatives which last week passed the MTEF/FSP, the senate the recommendations of the joint committee ahead of the presentation of the 2025 budget by President Bola Tinubu. The key recommendations passed by both houses include:

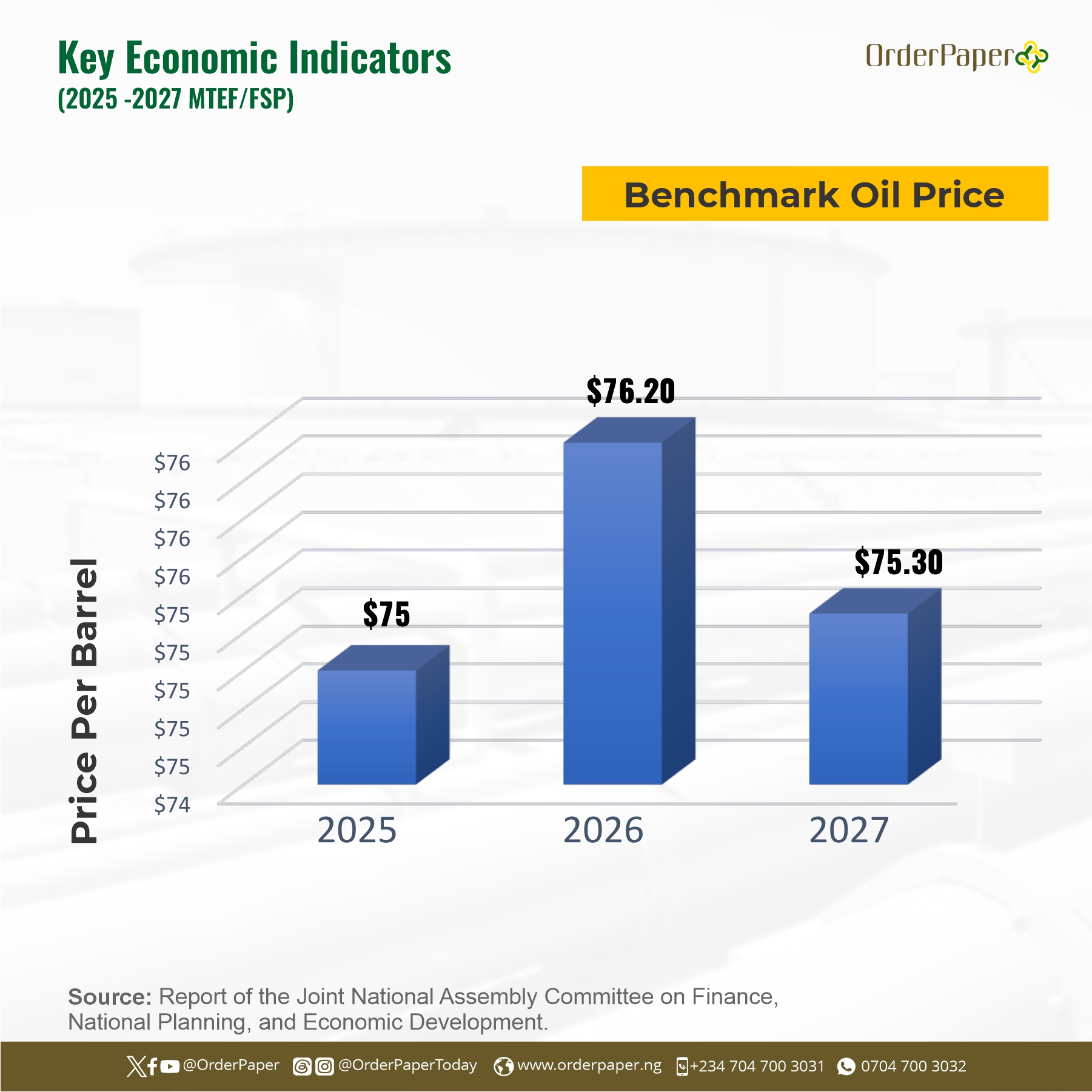

- Projected oil benchmark prices of USD75, USD76.2 and USD75.3 per barrel be approved for 2025, 2026 and 2027 respectively.

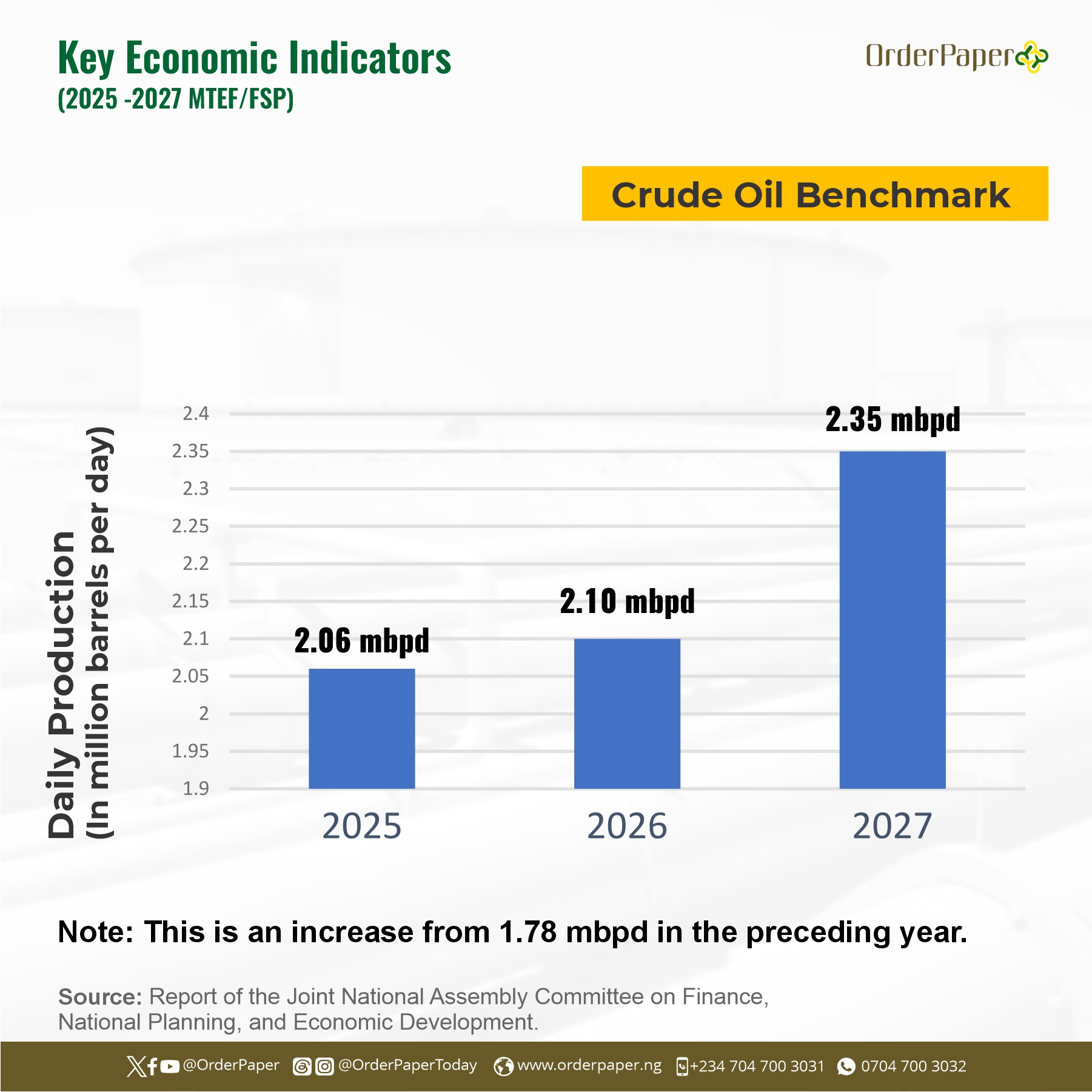

- Domestic crude oil production o 2.06, 2.10 and 2.35 mbpd for 2025, 2026 and 2027.

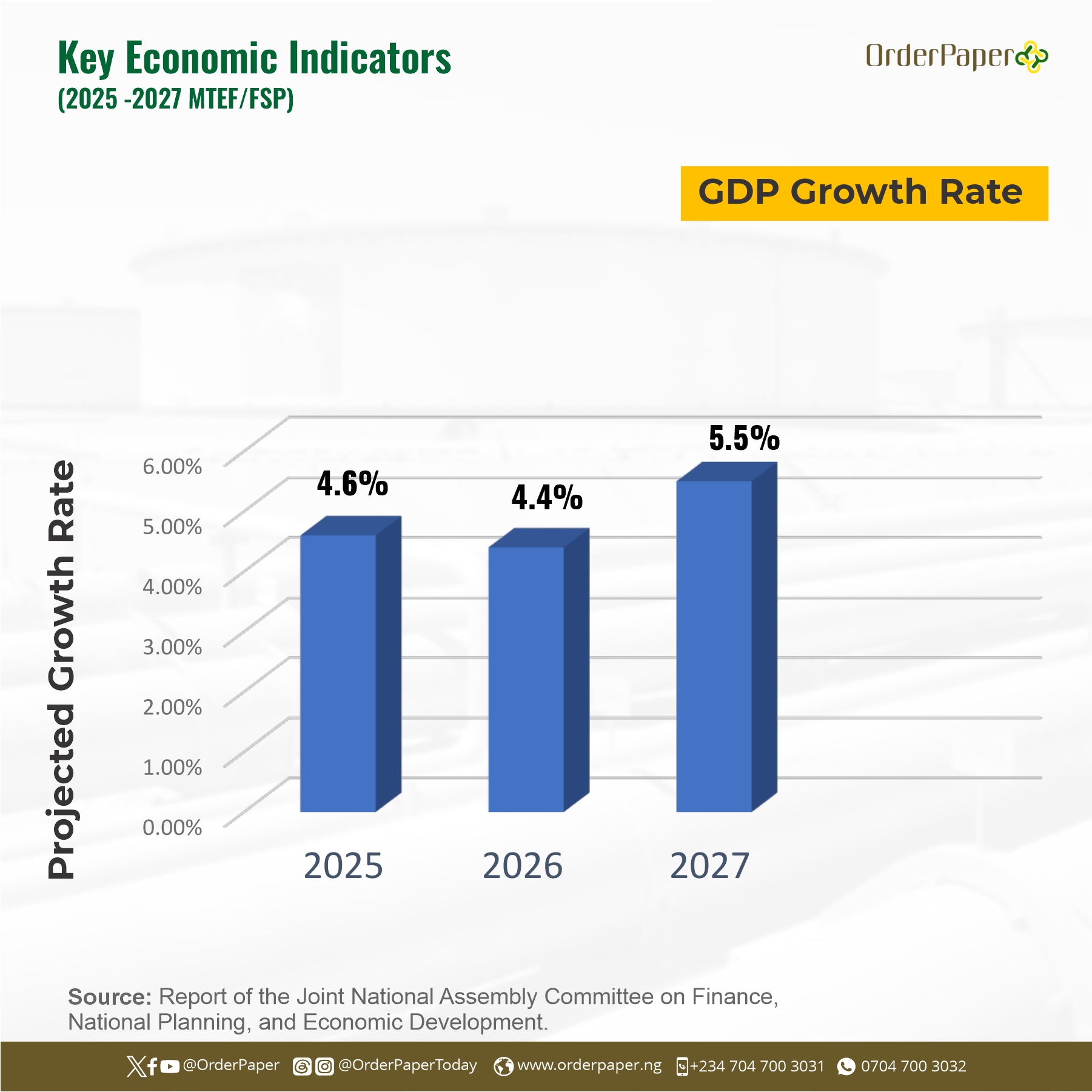

- Gross Domestic Product (GDP) growth rate of 4.6%, 4.4%, and 5.5% for 2025, 2026 and 2027 respectively.

- Exchange rate of NGN1400/USD for years 2025, 2026 and 2027.

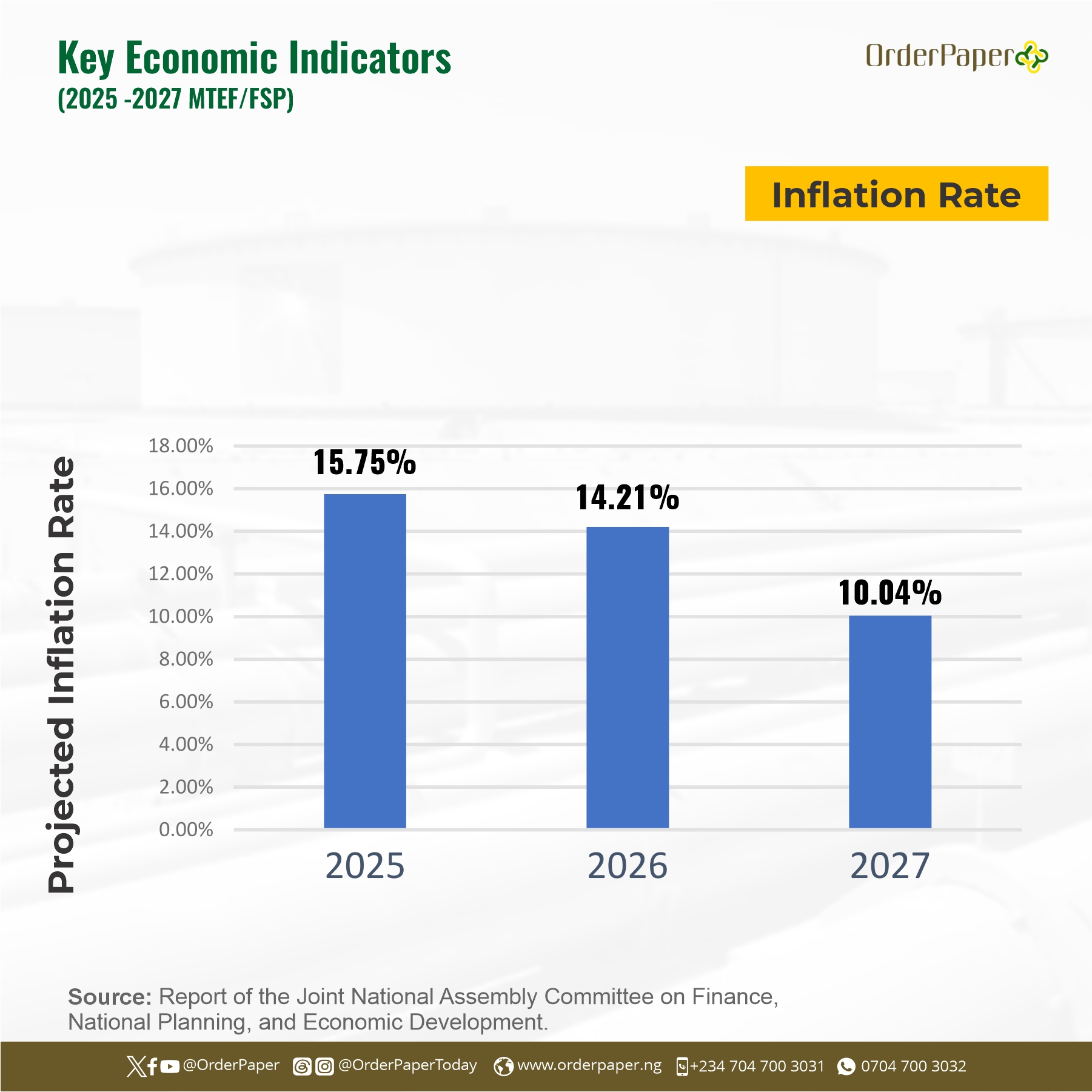

- An inflation rate of 15.75%, 14.21% and 10.04% for 2025, 2026 and 2027

Presenting the report, the Chairman of the joint committee, Sen. Sani Musa (APC, Niger East) noted that following a thorough review of the submissions presented by government departments and agencies, the joint committee noted that some critical agencies such as NNPC, NLNG, Nigeria Immigration Service (NIS) and others that are relevant to the attainment of set revenue targets engage in PPPs and JVAs that are inimical to the revenue growth of the country.

What are PPPs?

The 3P is a long-term arrangement between the public and private sectors to finance, build, and operate projects. They can be used to develop infrastructure, such as parks, public transportation networks, and convention centers. PPPs can help governments meet the demand for infrastructure development, and they can also help develop local private sector capabilities.

What are Joint Ventures

A joint venture is a partnership where public and private sector partners pool resources, finances, and expertise. The public sector may retain management control of the joint venture company, or transfer most of the shares to the private sector.

Findings and issues identified

- Revenue leakages in critical agencies

The committee averred that NNPC, a major contributor to national revenue, operates under JVAs and production-sharing contracts often favor private partners over the government. This has led to discrepancies in remittances to the Federation Account.

It also said the NLNG, while a significant revenue generator, has entered into agreements that allow private stakeholders to retain disproportionate shares of dividends; and that the NIS, which generates substantial revenue through visa and passport fees, has been implicated in PPPs that limit the funds remitted to the federation account.

These partnerships and agreements have been labeled “inimical” to the country’s revenue growth, with the government consistently failing to meet projected revenue targets. This loss of critical funds exacerbates Nigeria’s fiscal challenges, including its rising debt profile and reliance on deficit financing.

Gaps in the MTEF?

The Medium Term Expenditure Framework (MTEF) serves as a critical fiscal planning tool, providing estimates of government revenue and expenditure over a three-year period. However, the effectiveness of this framework has been called into question due to revenue leakages associated with public-private partnerships (PPPs) and joint venture arrangements (JVAs). These agreements, while designed to attract investments and improve efficiency, have often undermined revenue targets, raising concerns about transparency and accountability in key government agencies.

READ ALSO: MTEF: What it means and why it matters

By scrutinising the investment and financial practices of the NNPC, NLNG, Immigration Services, and other agencies, lawmakers might be able to restore fiscal discipline and promote sustainable economic growth. The outcome of the investigation could serve as a blueprint for strengthening Nigeria’s revenue mobilisation efforts and ensuring that public resources are used to benefit the nation as a whole.