President Bola Ahmed Tinubu will present his first MTEF/FSP this week before the National Assembly. Before this, it is important to do an overview of the impact of these policy documents under the immediate past administration of President Muhammadu Buhari.

Apart from the yearly budgets that spell out in clear terms the economic projections of an administration for the economy, the Medium-Term Expenditure Framework (MTEF) and the Fiscal Strategy Paper (FSP) provide details of the historical performance of past budgetary forecasts as well as estimates of government revenues and expenditures per time.

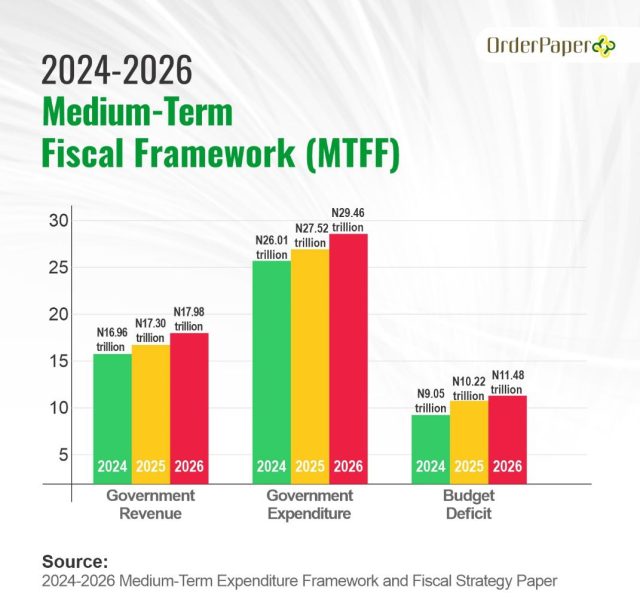

The MTEF/FSP is a requirement before laying the national budget as prescribed by law. This complies with the provisions of the Fiscal Responsibility Act (FRA) 2007. The projections, expenditure plans and fiscal targets over the medium term are often based on a reliable and consistent fiscal outlook. The MTEF is viewed as a sequence of three interconnected stages – a medium-term fiscal framework (MTFF), a medium-term budgetary framework (MTBF), and a medium-term performance framework (MTPF). When received by the National Assembly, the MTEF/FSP is usually referred to the Committees on Finance to lead other standing committees for further legislative work.

The 2024-2026 MTEF/FSP and the Buhari years

The key assumptions of the expenditure framework for 2024 show that the executive has fixed oil benchmark at $73.96, an inflation rate of 21.4%, and Gross Domestic Framework (GDP) of N236.3trn.

The 2024 to 2026 MTEF/FSP has set the oil benchmark price for the next three consecutive years at $73.96, $73.76, and $69.90, respectively.

According to the proposal from the executive, the economic growth rate over the next three years would be higher than the modest rates recorded since the end of the recession in 2020.

This is in sharp contrast to the MTEF/FSP in the last three years under President Muhammadu Buhari. The Buhari-led administration focused on some non-oil revenue sources, including Companies Income Tax (CIT), Value Added Tax (VAT), Customs and Excise duties, and Mining, with a view to boosting revenue accruals. The administration appeared to have recorded some measures of success in this area.

The crude oil production was pegged at 1.86 barrels a day, at a price of $40 per barrel. The projected exchange rate of the naira to the dollar was N379 to $1. The total amount proposed for foreign and domestic loans stood at N4.28 trillion, while the projected fiscal deficit of the budget was N5.20 trillion. The total proposed expenditure is N13.08 trillion, while revenue is N7.89 trillion.

Impact on the economy

It is a non-disputable fact that the Buhari government came in with oil prices nosediving with little earnings from crude exports hovering between $85/barrel and $20/barrel, leading to economic recession and high inflation from 2016 to early 2017. Also, as of December 31, 2019, Nigeria’s public debt stock had risen to $84.052bn (about N27.401tn) from about $63.806bn or N12.11tn on June 30, 2015.

Many Nigerians criticised the government for failing to live up to the promise of stabilising the economy, tackling insecurity and creating more jobs for the millions of unemployed, mostly youths. Also, Nigerians lampooned the government for non-performance, mainly as the government came into power with a mouthed promise of diversifying the revenue base of Nigeria into non-oil revenue sources with a focus on agriculture, mining and exports.

However, it must be acknowledged that the 2020-2023 MTEF/FSP were prepared during complex, severe health and economic crises inflicted by the COVID-19 pandemic. The macroeconomic conditions had a significant toll significantly on the Nigerian economy.

Getting it right

Some experts have suggested that the rising debt stock undoubtedly might have negative implications for human development and the economy, therefore recommending that the tax system be made more effective to increase revenue generation. Some experts have further suggested that they should adopt alternative financing measures such as Public-Private Partnerships (PPPs), and, above all, comply with the Fiscal Responsibility Act.