OrderPaper in this piece, highlights the chronicles of its intervention in the Student Loan Act as well as the genesis of the bill now turned Law.

Tertiary education in Nigeria has faced several challenges, primarily funding with a significant impact on quality and access.

In the 2024 budget, out of the N28.7 trillion approved by the National Assembly and passed by President Bola Tinubu, only N1.44 trillion was allocated to the education sector. Though this might seem like a lot, it was less than the mandatory United Nations Educational, Scientific and Cultural Organization (UNESCO) criterion, which suggested that allocating 25% of the national budget to education would positively impact the country’s education system.

From the education ministry’s budget, personnel cost will consume N1.04 trillion, while overhead and capital expenditure were allocated at N72.12 billion and N330.36 billion respectively.

According to the United Nations International Children’s Emergency Fund (UNICEF), one in every five of the world’s out-of-school children is in Nigeria.

The Minister of Education, Prof Tahir Mamman, also disclosed that Nigeria accounts for 45% of out-of-school children in West Africa and this situation can be attributed to the need for more funding and efficient budget utilisation.

On the contrary, one major element causing an epidemic of out-of-school children is the high cost of schooling. Many families, particularly the underprivileged, find it difficult to pay for the expenses of sending their kids to school, including books, tuition, and transportation. As a result, many students face obstacles that prevent them from pursuing their academic goals. This is where the Student Loan Act addresses some of these educational challenges.

Although it generated many reactions concerning limitations surrounding it necessitating calls for its amendment, 48 hours before its scheduled launch, the Federal Government announced the indefinite postponement of the scheme.

Subsequently, President Tinubu forwarded a letter to the Senate and the House of Representatives, seeking a repeal and re-enactment of the (Access to Higher Education) Act (Repeal and Re-Enactment) Bill, 2024, otherwise known as the Student Loan Act.

The President’s request for a repeal and re-enactment may not be unrelated to multiple criticisms directed against the qualifying requirements for applicants, repayment programmes, and governance structure, even if it was stated to have been postponed owing to continuing adjustments.

The genesis of the Students Loan Act

Access to Higher Education Act, 2023, popularly known as the “Student Loan Act,” the bill, first introduced in 2016 by Rep Femi Gbajabiamila, the immediate past Speaker of the House of Representatives was reintroduced in 2019 and received more attention from the National Assembly in November 2022, barely a month after the end of an eight-month-long industrial action by the nation’s university workers’ union who had protested poor working conditions, among other demands.

The Act seeks to provide easy access to higher education for Nigerians in any public institution of higher learning in Nigeria, through interest-free loans from the Nigerian Education Bank.

On Monday 12 June, 2023 President Tinubu signed the Access to Higher Education Act 2023 into law in fulfilment of his campaign promise to institute a pilot student loan regime that will expand access to education regardless of backgrounds. Popularly known as the “Student Loan Act”

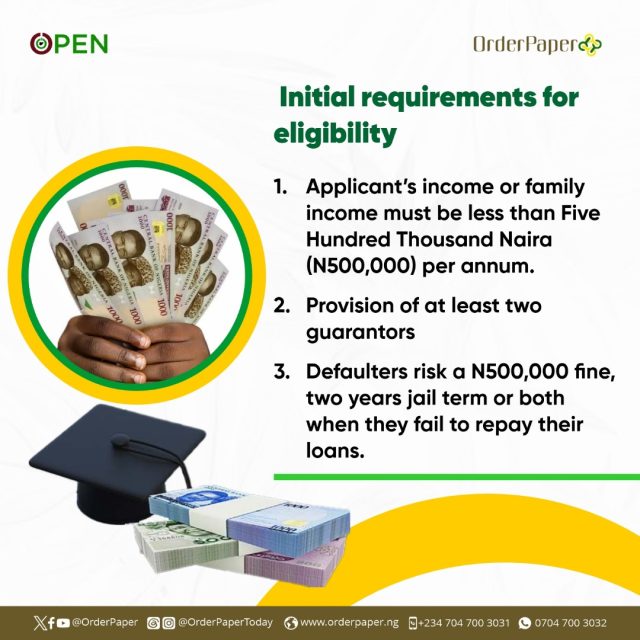

Initial requirements for eligibility

- Securing admission into any of the Nigerian Universities, Polytechnics, Colleges of Education, or Vocational Schools established by the Federal Government or State Government.

- Applicant’s income or family income must be less than Five Hundred Thousand Naira(N500,000) per annum.

- Provision of at least two guarantors; each of the guarantors must be a civil servant of not less than level 12 years in service or a lawyer with at least ten (10) years post-call experience; a judicial officer; a justice of peace.

- Defaulters risk a N500,000 fine, two years jail term or both when they fail to repay their loans.

Oppositions to the Act

Introduced as part of measures to address the education funding gap in the tertiary sector, the Act has been met with excitement on one hand and severe criticism on the other.

However, the President of the Academic Staff Union of Universities (ASUU) Emmanuel Osodeke, described the move as the government’s attempt to ‘systematically’ wash its hands off the funding of public universities and make university education beyond the reach of poor Nigerians. He proposed that institutions and students get grants from the federal government in place of student loans. According to him, only a few private university owners stand to benefit from student loans.

As expected, a few days later the Ministry of Education declared that the federal government could no longer afford to support institutions, resulting in an absurd increase in fees. On August 24, Usman Barambu, the president of the National Association of Nigerian Students (NANS), demanded that the legislature examine the Act to make it easier to access and take into account current economic conditions.

The ASUU National Treasurer, Professor Olusiji Sowande also argued that the act is unfair because unity schools do not charge tuition. According to him, students simply pay sundry fees to cover the cost of housing, ICT, power, and other expenses.

NANS also condemned the time frame for the repayment of the loan, tagging it as “unrealistic” because less than 10% of Nigerian graduates get absorbed into the labour force upon completion of their NYSC.

They therefore proposed a minimum of five years repayment duration as against the two-year post-National Youth Service Corp (NYSC) repayment time frame, given the challenges of unemployment after graduation.

Interventions by OrderPaper

Nigeria’s foremost independent parliamentary monitoring organisation and policy think tank, OrderPaper in commemoration of the year 2024 International Day of Education (IDU), held its OrderPaper Parliamentary Engagement Nigeria (OPEN) Space monthly discourse on X on 24th January 2024 featuring prominent thought leaders who spoke on “Breaking Barriers: Addressing Educational Inequality through the Student Loan Act.”

Panellists who were featured in the discourse include the Chairman, Ethics, Code of Conduct and Public Petitions, Senator Neda Bernards Imasuen (LP, Edo South) joined by Rep. Terseer Ugbor (APC, Benue) who spoke on the issues facing the student loan and ways to make it realistic and feasible to implement,

Other panellists featured in the discourse were, Prof. Uwakwe Abugu, Professor of Medical Law at the University of Abuja, and Aisha Ouwakemi Yusuph, a 500-level law student from the University of Abuja.

Also in an exclusive interview with OrderPaper, Rep. Terseer Ugbor, gave insights on plans by the parliament to ensure a robust implementation of the law on student loans. In this concluding part of the interview, the lawmaker takes a swipe at the Academic Staff Union of Universities (ASUU) for advocating for grants instead of student loans.

He said “ Many countries around the world including America, Europe, Canada, and China, all operate on student loans systems but in Nigeria, our ASUU which are supposed to be partners in progress are rejecting a very important scheme like this.

“It just shows pure selfish interest; they are looking after themselves, and they don’t want the universities to be autonomous. They define autonomy in their term, how they think autonomy should operate, so they want to eat their cake and have it which I think at this point, the government needs to put its foot down on the issue of ASUU and make sure that we implement this student loans scheme very well.”

READ ALSO: INTERVIEW: ASUU opposed to student loans for selfish reasons – Rep Ugbor

Aside from several explainers giving in-depth knowledge into the Students Loan Act, OrderPaper took to the streets on one of her Street Parliament Series (SPS) to get citizens’ opinions. In this episode, citizens expressed mixed reactions to the criteria stipulated to access the loan.

Watch: Street Parliament: Citizens react to Students Loan Act