Crude oil production is a vital aspect of the MTEF benchmarks upon which the government builds revenue prospects to fund service delivery.

Nigeria’s crude oil production is pivotal to its economy. With extensive reserves, which are concentrated primarily in the Niger Delta region, the country is one of the largest oil producers in Africa and a key player in the global energy market. Daily crude oil production in Nigeria has historically contributed significantly to its revenue, constituting a substantial part of its export earnings.

However, oil production has fluctuated over the years and is subject to several factors, including geopolitical issues, security concerns, and technical challenges. Daily production levels are critical to Nigeria’s fiscal planning, as they directly influence the revenue projections necessary for the annual budget.

In this article, we explore Nigeria’s crude oil production, its connection to the quotas allocated by the Organization of the Petroleum Exporting Countries (OPEC), and how these factors affect the Medium-Term Expenditure Framework (MTEF). We delve into the impact of these interconnections on Nigeria’s fiscal planning, economic stability, and the challenges that must be addressed.

READ ALSO: Energy transition: Biofuel as viable alternative to fossil fuel

MTEF benchmarks and fiscal planning

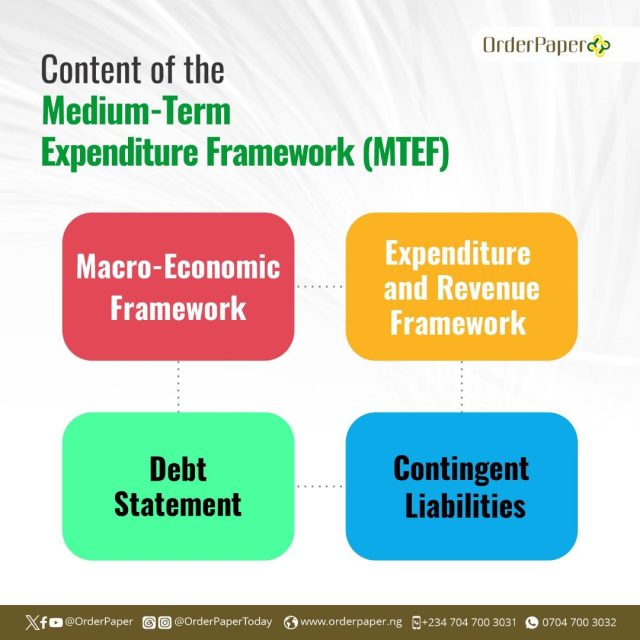

The Medium-Term Expenditure Framework (MTEF) is a crucial part of Nigeria’s fiscal planning and aligns with the Fiscal Responsibility Act (2007). It serves as a policy document that outlines the nation’s fiscal strategy and expenditure priorities over a medium-term horizon. The medium-term planning plays a pivotal role in achieving sustainable economic development and promoting effective governance. By extending beyond short-term budgeting, medium-term planning ensures fiscal policy coherence, stability, and predictability. The MTEF benchmark includes projections for oil production levels, oil prices, and revenue expectations, which are vital for budgetary planning and resource allocation.

These projections directly impact Nigeria’s budget planning and financial sustainability. MTEF benchmarks must be realistic to ensure the federal budget aligns with long-term economic goals and fiscal stability. Any unrealistic benchmark can lead to budget deficits, affecting the government’s ability to provide essential public services and drive economic growth.

READ ALSO: Senate receives 2024-2026 MTEF/FSP for approval

GDP and a declining trajectory

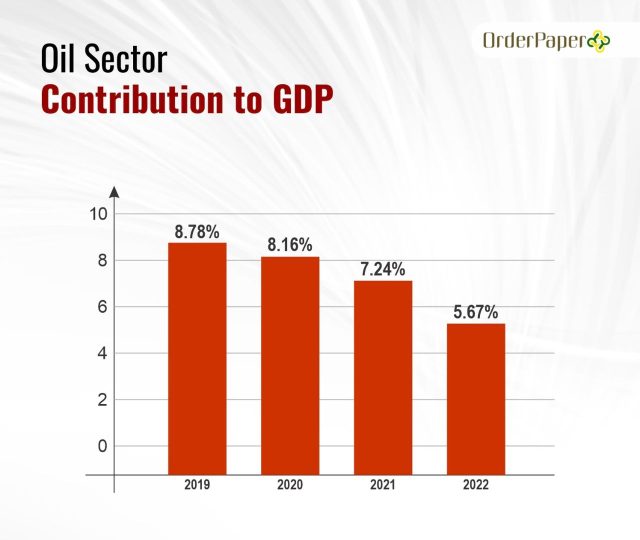

The contribution of petroleum (oil and gas) production to the Nigerian Economy has recently reduced significantly. According to the 2024-2026 MTEF & FSP (Fiscal Strategy Paper), the contribution of the sector to the real Gross Domestic Product (GDP) declined from 8.78% in 2019 to 8.16% in 2020, 7.24% in 2021, and 5.67% in 2022.

OPEC quotas and declining production levels

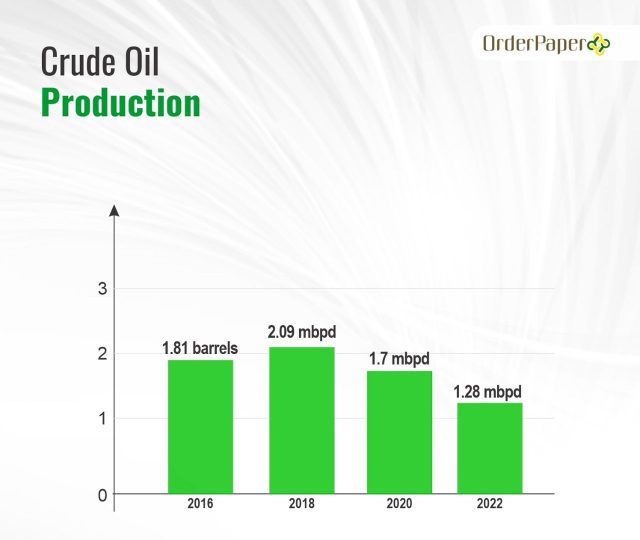

There has also been a significant decline in terms of production. From 1.81 million barrels a day (mbpd) in 2016, average crude oil and condensate production (net of incremental production for Repayment Arrears) peaked at 2.09 mbpd in 2018 but declined continuously thereafter to 1.7 mbpd in 2020 and 1.28 mbpd in 2022. Data from the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) shows that an average of only 1.37 mbpd of crude oil was produced between January and July 2023.

In recent years, Nigeria has been allocated specific production quotas by the Organization of Petroleum Exporting Countries (OPEC) to balance national interests and the organization’s objectives. Compliance with these quotas is essential to maintain good standing within OPEC and uphold the stability of global oil markets. However, from the above statistics, Nigeria has been unable to meet its 1.8mbpd current OPEC quota.

READ ALSO: NASS pass N2.17tr Supplementary budget, receive MTEF

The importance of the quota cannot be overemphasized, as OPEC allocates production quotas to its member countries to manage and influence oil prices. These quotas, collectively determined by OPEC, ensure stability in the oil market and prevent oversupply or undersupply. Not meeting this quota can lead to a loss of credibility within the global oil market, strained relations with other member countries, and further impact a country’s standing within the body and its ability to influence OPEC decisions.

The MTEF benchmarks for crude oil production are projected at 1.78mbpd, 1.80mbpd, and 1.81mbpd in 2024, 2025 and 2026, respectively. This implies that oil production would take a year to meet the OPEC quota, according to the MTEF document.

In terms of earnings, the benchmark for oil price is capped at $73.96 per barrel for 2024, $73.76 per barrel in 2025 and $69.90 per barrel in 2026. This is the kernel upon which the government hopes to raise revenues to fund the annual budgets captured in the MTEF.

The 2024 budget has a proposed ₦26.01 trillion expenditure profile. This is in contrast to ₦21.83 trillion in 2023. The 2024 budget includes statutory transfers of ₦1.3 trillion, non-debt recurrent expenditure of ₦10.26 trillion, Debt service estimated at ₦8.25 trillion as well as ₦7.78 trillion being provided for personnel pension cost.

In the first half of 2023, budget performance analysis shows that the government generated revenue of ₦4.06 trillion against a pro-rata target of ₦5.52 trillion. Out of the ₦4.06 trillion generated, ₦4.02 trillion was used to service debt, representing 99% of the revenue. This is against ₦3.15 trillion on a pro-rata basis and a total of ₦6.31 trillion budgeted for the year.

READ ALSO: Reps pledge speedy passage of 2024 budget

The implication of this is the budget falling into deficit, which continues the constant need for borrowing and adjustments to government spending plans. Therefore, the MTEF benchmarks for oil production and sale are critical in determining whether revenue targets are met, and that government can effectively deliver services to citizens.

Experts have stated that the budget performance of the first half of 2023 represents the wrong fiscal position, requiring spending efficiency and a strong revenue generation drive. Given the performance of the 2023 budget, many questions have arisen about the sustainability of the MTEF benchmarks. Can Nigeria meet the MTEF crude production benchmark for 2024, 2025 and 2026? Can Nigeria also meet the OPEC quota? What must the government do to ensure that the production benchmark and the OPEC quota are met?

READ ALSO: MTEF/FSP: As Tinubu takes the baton from Buhari

Why the national assembly must do a thorough job

Meeting the MTEF benchmarks requires a comprehensive and coordinated effort involving various government agencies, industry stakeholders, and a commitment to sustainable and responsible oil production and management.

Also, the government may consider revising the benchmark for oil production to align revenue projections with the actual performance of the oil sector. This is why legislative scrutiny to ensure the production of practicable projections and realistic benchmarks cannot be over-emphasized. The National Assembly must take active steps to thoroughly scrutinize the MTEF to avoid budget deficit and for accountability, transparency, fiscal responsibility, and debt management.

READ ALSO: Reps to investigate non-payment of judgment debts

OPEC quota and what the government can do

To ensure that Nigeria meets its OPEC quota, the government can take several measures, including the following:

- Invest in Infrastructure: Upgrade and invest in the necessary oil production and transportation infrastructure. This can help increase production efficiency.

- Technology and Innovation: Implement advanced technologies and best practices in the oil industry to enhance production and reduce waste.

- Maintenance and Repairs: Regular maintenance of oil facilities to prevent unplanned downtime and production disruptions.

- Security: Address security concerns, such as oil theft and pipeline vandalism, which can disrupt production.

- Diversify the Economy: Reduce the country’s reliance on oil revenue by diversifying the economy. This can be achieved by promoting other sectors like agriculture, manufacturing, and services.

- Transparency: Improve transparency and accountability in the oil sector to reduce corruption and ensure accurate production and revenue figures.

- International Partnerships: Collaborate with international partners and organizations to access expertise and technology for the oil industry.

- Environmental Compliance: Ensure compliance with environmental regulations and responsible environmental practices in oil production to avoid disruptions due to environmental concerns.

- Fiscal Responsibility: Implement responsible fiscal policies to manage oil revenues efficiently and save for times of lower oil prices.

- Invest in Human Capital: Invest in the education and training of the workforce in the oil sector to improve skills and productivity.

- Diversify Export Markets: Seek out new export markets for oil and reduce dependence on a single market, which can be vulnerable to fluctuations.

- Political Stability: Ensure political stability and minimize disruptions caused by strikes, protests, or political conflicts that can affect oil production.

Last word

Nigeria’s crude oil production and the MTEF benchmarks are intricately linked, impacting fiscal planning and economic stability. Nigeria must carefully manage its oil-dependent economy and address challenges like price volatility, security concerns, and sustainability. By diversifying its revenue sources, fostering transparency, and adhering to the principles of the MTEF, Nigeria can navigate the complexities of its oil-driven economy and work toward a more stable and diversified economic future.