Despite marginal and sometimes substantial differences between budgeted oil price benchmark and average sales every year, the excess crude account is constantly depleting

Every year fiscal benchmarks are set by the Nigerian government, usually for the following budget year and for the succeeding three years in the case of the Medium-Term Framework (MTEF). The benchmarks cover a variety of elements ranging from the anticipated naira to dollar exchange rate, crude oil production in barrels per day and the crude oil price.

Nigeria, as a major oil-producing nation, relies heavily on the sale of crude oil denominated in US dollars per barrel of the product to fund its budget and drive economic growth. The actual intent of the set benchmarks in regard to crude oil price is to manage expectations given the volatility of oil prices thereby ensuring fiscal stability.

READ ALSO: ANALYSIS: Nigeria’s budget and bogus oil benchmarks

Benchmark price and the excess crude account

The average oil price for a fiscal year is the actual price at which Nigeria’s oil is sold in the global market. It fluctuates in response to market dynamics, geopolitical factors, supply and demand, and other external influences. The average oil price may vary significantly from the projected oil price benchmark, leading to either revenue shortfalls or windfalls for the Nigerian government. This benchmark is compared to the average oil price and influences the allocation of funds. In order to mitigate the revenue fluctuations, a contrivement called the Excess Crude Account (ECA) was put in place.

Nigeria’s Excess Crude Account established in 2004 to serve as a reserve fund to save any excess revenue generated from oil sales when the average oil price exceeds the budgeted oil price benchmark. It acts as a buffer, helping to smooth out the impact of oil price fluctuations. These saved funds support fiscal stability and ought to be utilized during times of revenue shortfalls caused by lower oil prices or other economic challenges.

READ ALSO: INSIGHT: Oil, revenue and the MTEF benchmarks

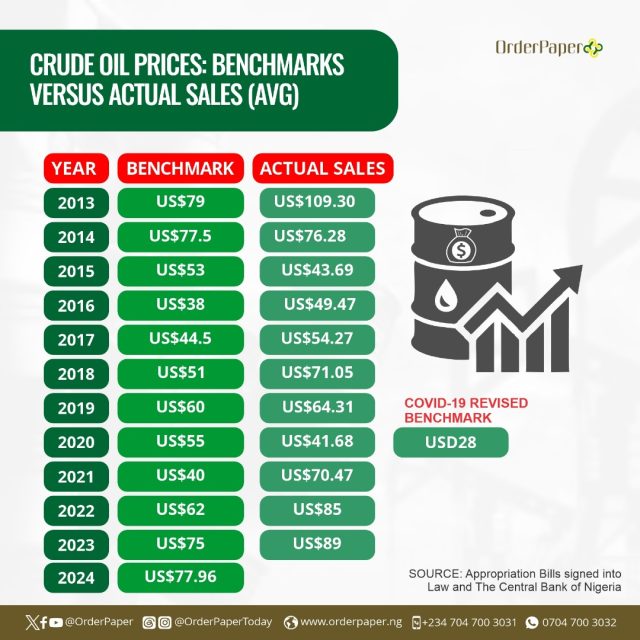

Below is Nigeria’s approved benchmark for crude oil price in the last ten years and the average price for each year:

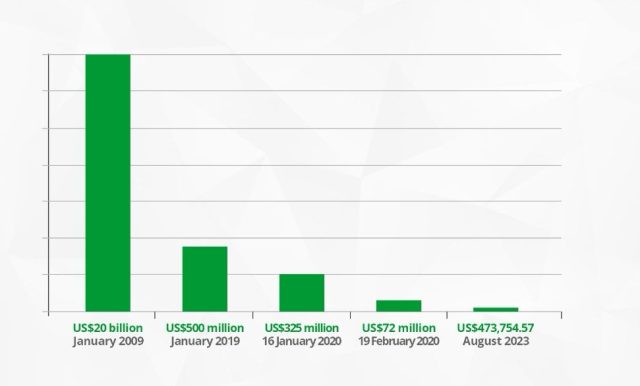

From the above, it can be observed that due to volatility and fluctuations, the actual oil prices and the approved benchmarks hardly ever correlate. The ECA mechanism provides that in the times when actual sales are higher than benchmark price, the extra revenues are put into the excess crude account as savings for the country for use in the proverbial rainy days. However, one would realize that over the years, the government has been unable to make judicious use of these funds. Such bumper savings are known to have elicited contentions between the federating units of the country in the past. For instance, during the tenure of Dr. Ngozi Okonjo Iweala as finance minister and coordinating minister of the economy, the powerful bloc of state governors had insisted that the monies in the account be shared amongst the tiers of government instead of being saved. The matter was eventually litigated and that era marked substantial slide of the excess crude account on a continual basis. The illustration below represents data from the Federal Allocation Accounts Committee (FAAC) and the National Economic Council (NEC).

Depleted account with little or nothing to show…

As at August 2023, the National Economic Council revealed that the nation’s ECA stood at US$473,754.57. This is a massive decline from 2009 as can be seen from the above graph. This massive depletion cannot however be justified given the large-scale decay of public infrastructure and poor performance of social services, including healthcare, education, and sanitation, etc, over the years. Just as accusing fingers can be pointed to the federal government for the frittering of this fund, the state and local governments cannot be excused of blames as same governance deficits are prevalent on services on the concurrent and residual lists of the constitution. Unfortunately and importantly, a major part of the problem is that there is currently no law that codifies the excess crude account, thereby defining its purpose and restrictions. The account seems to be similar to a piggy bank that can be accessed at any time by the government without much care for transparency and accountability.

The justification or legality of the ECA boils down to issues of internal political struggles and cohesion between the Executive, National Assembly, and the State Governments. Whereas some government officials believe that the ECA should be scrapped, others believe it should be legalised and codified to allow it serve value to the country. To give the ECA legal backing, lawmakers first need to trash out the various areas of conflicts. Should all tiers of government have power over the account? Should the monies in the account be appropriated by the National Assembly? Should the Excess Crude Account and the Sovereign Wealth Fund continue to coexist together?

READ ALSO: My 2024 budget lays foundation for greater Nigeria – Tinubu

Sovereign Wealth Fund as viable alternative

Nigeria initiated the Sovereign Wealth Fund (SWF) in what some economic analysts saw as a way of addressing the controversies around the ECA. Consequently, in 2018, the fund commenced operations as managed by the Nigeria Sovereign Investment Authority (NSIA). The question that has remained unanswered is that with the operation of the SWF, why does Nigeria still continue to maintain the nebulous ECA? Given the SWF’s legal status, organised structure, and wider scope, why can’t the excess crude account be subsumed into it? As with other questions surrounding the ECA, there seems to be no simple answer.

READ ALSO: MTEF/FSP: As Tinubu takes the baton from Buhari

Onus lies on the National Assembly

These controversies require the National Assembly to rise up to its responsibilities of law-making and oversight. As stipulated in Sections 80-82 of the Constitution of the Federal Republic of Nigeria 1999 (as amended), the federal legislature has full powers over the public purse. This is why it is expected to carry out due diligence on budget estimates presented to it by the president before approval. It is the same reason why it must thoroughly consider the Medium-Term Framework (MTEF) proposed by the Executive before passage. This is very crucial given the importance of the annual crude oil production benchmarks and actual sales dictated by both internal and external factors. Realistic crude oil production and price benchmarks are vital to resolving the issues around the ECA, economic growth and development, and indeed, service delivery by the government.

The legislature must end the practice of hasty approvals of the MTEF and annual budgets. This will help to effectively safeguard the economy and sanitise the country’s fiscal space.