This CBN amendment bill, aimed at refining certain provisions of the CBN Act 2007, carries significant implications for Nigeria’s financial landscape.

The Central Bank of Nigeria (CBN) Act 2007 stands as a cornerstone of Nigeria’s financial regulatory framework, outlining the roles, functions, and powers of the apex bank. Recently, the Nigerian Senate has brought forth a significant development in the form of the CBN Amendment Bill, aiming to revise certain provisions of the existing Act.

This proposed amendment has sparked discussions and debates within financial circles, as it holds the potential to shape the country’s monetary policies and regulatory landscape. Let’s delve into the key elements of the bill and its potential implications.

Title

An Act to Amend the Central Bank of Nigeria Act No. 7 of 2007 (To Further Empower The Bank To Carry out its Principal Objectives In Line With Section 2 Of The Act, Make The Bank More effective, and bring it in line with current realities, best practices, and other related matters).

Key elements of the bill

- Re-capitalisation

The bill seeks to amend the CBN capital from one hundred billion to one trillion.

- Interim Board

The President can constitute an interim board of the existing directors of the bank to carry out the functions of the board for not more than sixty (60) days.

- NASS Approvals

The CBN budget is to be considered and approved by the National Assembly in line with the provision of the Fiscal Responsibility Act, 2007.

Introduces Chief Compliance Officer (COO)

The COO shall at intervals of three months prepare a report on compliance by the Bank with the provisions of the Act covering the three months preceding the preparation of the report and submit the report to the Board, the President and the relevant Committees of the National Assembly.

Tenure

The Governor, Deputy Governors, and Chief Compliance Officer shall be appointed for a single term of six years and no more.

Committee for Monetary and Fiscal Policies

The bill seeks the establishment of a Coordinating Committee for Monetary and Fiscal Policies (which is different from the existing (Monetary Policy Committee). The Committee shall consist of:

(a) the Minister of Finance, who shall be the Chairman;

(b) the Minister of Industry Trade and Investment;

(c) the Minister of Budget and Economic Planning;

(d) the Governor of the Bank;

(e) two external members of the Board of the Bank;

(f) The chief Economic Adviser to the President

(g) the Director-General, Securities and Exchange Commission;

(h) the Director-General Debt Management Office;

The objectives of the committee shall be to set internally consistent targets of monetary and fiscal policies that are conducive to controlling inflation and financial conditions of sustainable economic growth.

Experience and pedigree

The Governor and deputy governors shall be persons of recognised financial experience with at least a recognized and verifiable economic and financial background of not less than 15 years. The Chief Compliance Officer shall be a person of recognized and verifiable legal and/or auditing experience of not less than 15 years experience in audit and/or legal practice in Nigeria.

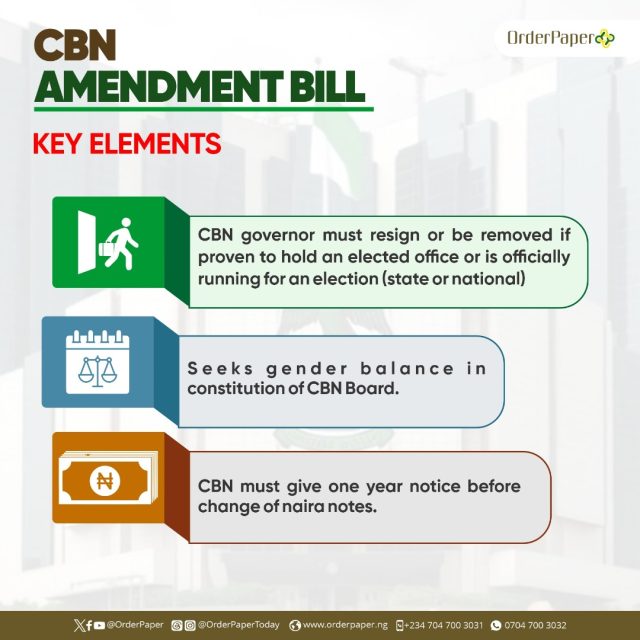

Elected office

The CBN governor must resign or be removed if proven to hold an elected office or is officially running for an election (state or national).

Gender Balance

The bill seeks gender balance in the constitution of the CBN Board.

Change of Naira notes

The CBN must give one year’s notice before the implementation of a change of naira notes.

Recommendation for removal by the National Assembly

If at any time, the National Assembly thinks that the Bank has failed to comply with the provisions of the Act, it may by notice require the Board to make good or remedy the default within a specified time. Failure to ensure compliance with the National Assembly leads to a sanction by a warning letter to the Governor and if the failure persists for up to 21 days after such warning, a recommendation for suspension or removal from office will be written to the President.

Refusal of Naira

A person who refuses to accept the Naira as a means of payment or prices or denominates the cost of any product or service or consummates any non-export business in Nigeria other than in Naira is guilty of an offence and liable to a fine of N500,000 (or 10% of the value of the transaction) or 6 months imprisonment.

Buying and selling of Naira

A person who buys/sells Naira notes at a mark-up is guilty of an offence and shall on conviction be liable to imprisonment for a term not less than six months or a fine not less than N500,000 or Ten per cent of the transaction value (which is higher).

Faces behind the Bill

The bill is sponsored by Senator Mikhail Adetokunbo Abiru (APC, Lagos East) and 31 others, including two of OrderPaper’s senators to watch out for: Senator Asuquo Ekpenyong (APC, Cross River South) and, Senator Opeyemi Bamidele (APC, Ekiti Central).

With additional reports by Olabode Afurewaju