The student loan policy has garnered significant traction recently with its indefinite postponement just 48 hours before its scheduled launch and a letter to the National Assembly from the President seeking a repeal and re-enactment of the Act.

The long-awaited implementation of the student loan policy garnered significant traction as the Federal Government announced the indefinite postponement of the scheme, just 48 hours before its scheduled launch.

The criticisms levelled at the qualifying requirements for applicants, repayment plans, and governance structure following the law’s signing may have some bearing on the decision.

OrderPaper held an Open Space Discourse in February 2024 to address educational inequality through the student loan bill – one of the key note speaker Professor Uwakwe Abugu from the University of Abuja Faculty of Law pointed out that the introduction of the loan program will lead to the introduction of tuition fees which will significantly increase the cost of higher education.

This thought line could also be another reason for the indefinite suspension of the scheme.

While the suspension was generating debates, President Bola Ahmed Tinubu forwarded a letter to the Senate and the House of Representatives, seeking a repeal and re-enactment of the Act, a day after the announcement of its suspension.

The President’s letter sought an expeditious consideration of the bill and the Senate has passed the Student Loan (Access to Higher Education) Act (Repeal and Re-Enactment) Bill, 2024, otherwise known as the Student Loan Act.

OrderPaper recalls that President Tinubu signed the bill into law in June 2023, aimed at establishing a Students Loan Fund (SLF) to provide interest-free loans to Nigerians pursuing higher education. The scheme was initially intended to commence between September and October 2023.

The submission of a new student loan bill before the National Assembly signals a significant legislative proposal aimed at addressing access to education financing.

Here is everything you need to know about the repeal and re-enactment bill.

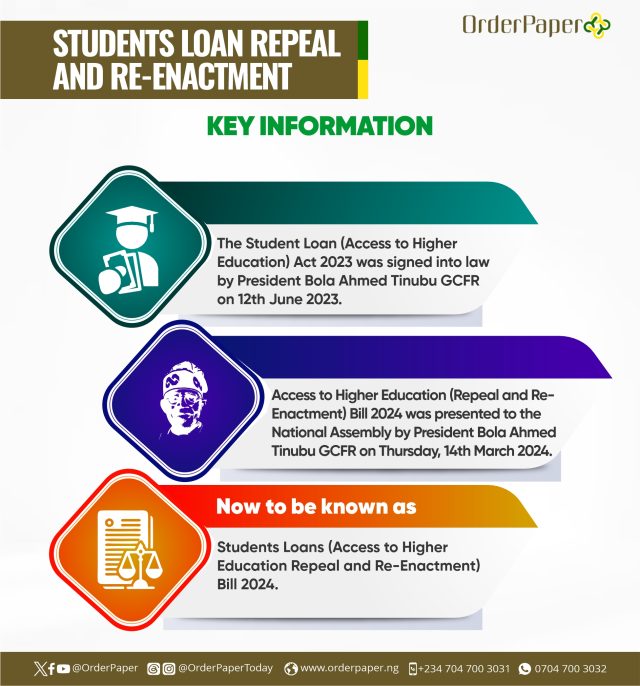

Key Information

The Student Loan (Access to Higher Education) Act 2023 was signed into law by President Bola Ahmed Tinubu GCFR on 12th June 2023.

Access to Higher Education (Repeal and Re-Enactment) Bill 2024 was presented to the National Assembly by President Bola Ahmed Tinubu GCFR on Thursday, 14th March 2024.

Now to be known as – Students Loans (Access to Higher Education Repeal and Re-Enactment) Bill 2024.

Key elements

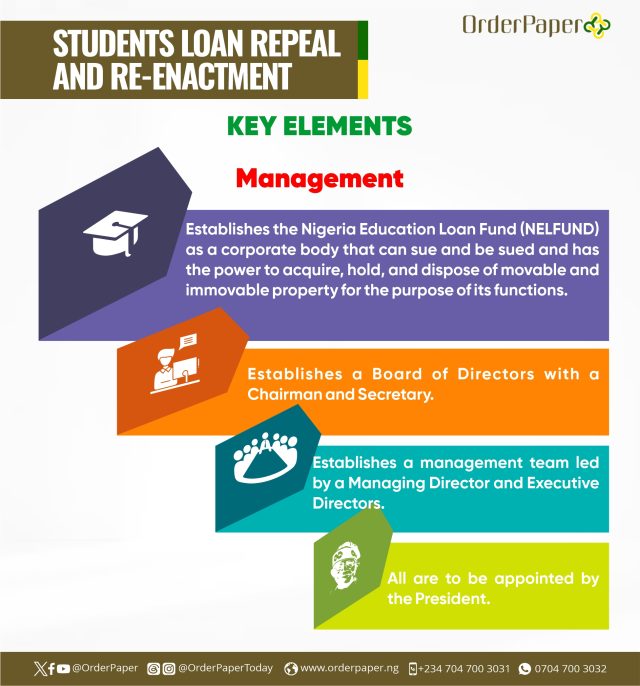

Management

Establishes the Nigeria Education Loan Fund (NELFUND) as a corporate body that can sue and be sued and has the power to acquire, hold, and dispose of movable and immovable property for the purpose of its functions.

Establishes a Board of Directors with a Chairman and Secretary.

Establishes a management team led by a Managing Director and Executive Directors.

All are to be appointed by the President.

Duty

Provide loans to qualified Nigerians for tuition, fees, charges, and upkeep during their studies in approved tertiary education institutions.

Build, operate, and maintain a diversified pool of funds to provide loans to qualified applicants.

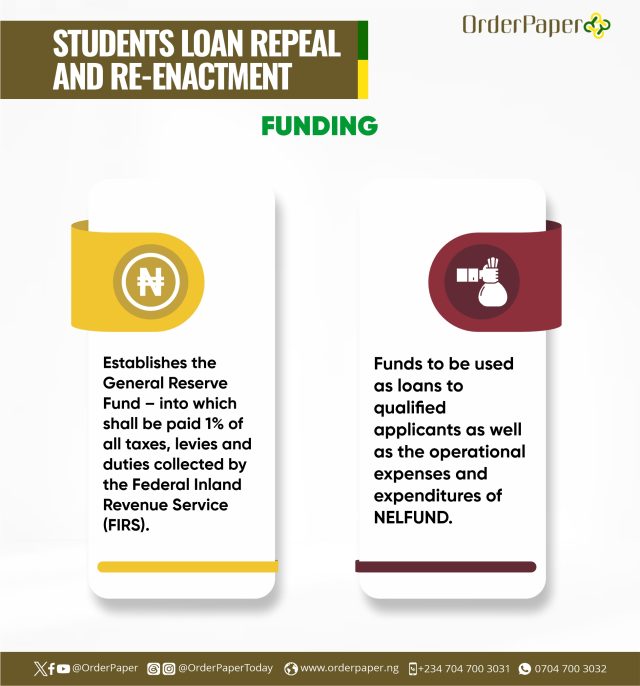

Funding

Establishes the General Reserve Fund – into which shall be paid 1% of all taxes, levies and duties collected by the Federal Inland Revenue Service (FIRS).

Funds are to be used as loans to qualified applicants as well as the operational expenses and expenditures of NELFUND.

Application

Students applying for the loan can not be disqualified based on their parent’s loan history.

Removes the family income threshold so Nigerian students can apply for these loans and accept responsibility for repayment according to the Fund’s guidelines.

Removes the guarantor requirement so that students can apply for and receive loans.

Ensures a minimum national spread of loans approved and disbursed in each financial year.

Loans to cover tuition and other fees payable to the school and maintenance allowance payable to the student.

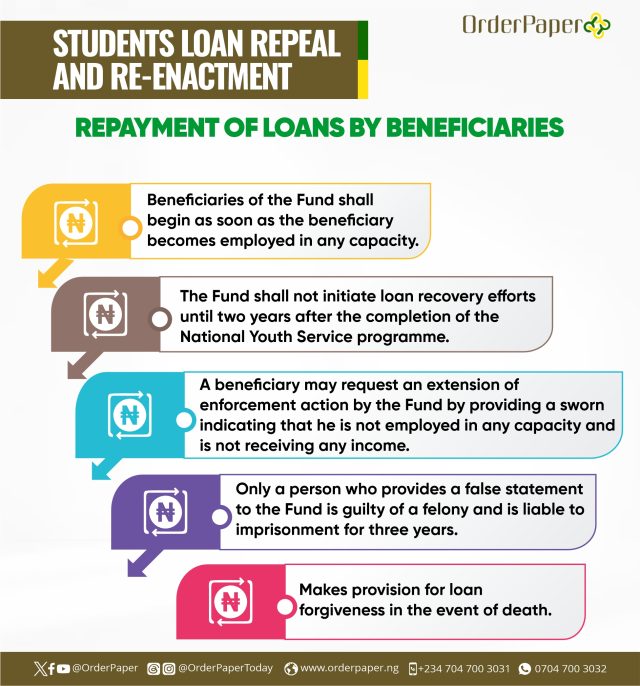

Repayment of loans by beneficiaries

– Beneficiaries of the Fund shall begin as soon as the beneficiary becomes employed in any capacity.

The Fund shall not initiate loan recovery efforts until two years after the completion of the National Youth Service programme.

A beneficiary may request an extension of enforcement action by the Fund by providing a sworn indicating that he is not employed in any capacity and is not receiving any income.

Only a person who provides a false statement to the Fund is guilty of a felony and is liable to imprisonment for three years.

Makes provision for loan forgiveness in the event of death.

In an Exclusive Interview with the Chairman of the Committee on Student Loan Bill (House of Reps), Rep. Terseer Ugbor (Kwande/Ushungo federal constituency of Benue State), OrderPaper was informed that lawmakers were bombarded with calls on school fees as he gave insights on plans by parliament to ensure a robust implementation of the law.