The decision by CBN to raise the Monetary Policy Rate (MPR) marked a substantial adjustment aimed at addressing the persistent inflationary challenges faced by the country.

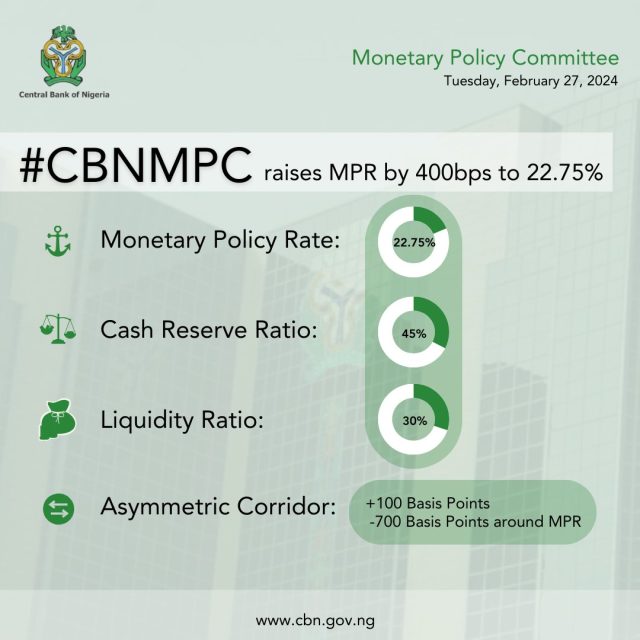

The Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) has raised the Monetary Policy Rate (MPR) by four hundred basis points to 22.75 per cent from 18.75 per cent.

In a pivotal move, the Apex Bank announced a significant shift in its monetary policy during the 293rd MPC meeting held on February 26 and 27.

The decision to raise the MPR by four hundred basis points, from 18.75 percent to 22.75 percent, marked a substantial adjustment aimed at addressing the persistent inflationary challenges faced by the country.

Governor Yemi Cardoso, who presided over the MPC meeting, revealed the unanimous decision of all 12 committee members to tighten monetary policy. This move comes against the backdrop of the continued fluctuation of the Naira against the USD and the prevailing economic hardships in Nigeria.

He said “All 12 members of the committee decided to further tighten monetary policy by raising the MPR by 400 basis points to 22.75 percent from 18.75 percent. Adjust the asymmetric corridor around the MPR to +100 to -700 from plus 100 to -300 basis points.”

Explaining the rationale behind the decision, Cardoso pointed to the current inflationary and exchange rate pressures, emphasizing the committee’s commitment to reversing the trend. With inflation already standing at 29.90 percent, the increased MPR is seen as a crucial step in tackling the rising inflation in the country.

Notably, the Cash Reserve Ratio (CRR) was also adjusted, rising from 32.5 percent to 45.0 percent, indicating a more stringent approach to liquidity management. However, the liquidity ratio remained unchanged at thirty percent.

During his announcement, Governor Cardoso highlighted the factors contributing to inflationary pressures, including exchange rate pass-through, escalating energy costs, a high fiscal deficit, and security challenges in key food-producing areas. He underscored the committee’s commitment to moderating the current economic hardship in the near term.

Looking ahead, Cardoso assured that the MPC would vigilantly monitor global and domestic economic developments to ensure a moderation of inflationary and exchange rate pressures.

The decision reflects the committee’s acknowledgment of the challenges faced by the Nigerian economy and its determination to implement measures aimed at achieving stability and economic resilience in the foreseeable future.

He said “To this end the committee will continue to monitor developments in the global and domestic economies to ensure that inflationary and exchange rate pressures moderate in the near term.”