The senate approved the budget benchmarks with a total spending of ₦47.9 trillion and a new borrowing plan of ₦9.22 trillion.

The senate has approved the 2025-2027 Medium Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP) ahead of the presentation of the 2025 Budget by President Bola Tinubu.

This is as it approved the expenditure framework with a total spending of ₦47.9 trillion and a new borrowing plan of ₦9.22 trillion which includes both domestic and foreign borrowings.

The approval followed the consideration of a report by the joint committee on finance and national planning and economic affairs on the 2025-2027 MTEF/FSP during Tuesday’s plenary.

OrderPaper recalls that President Tinubu submitted the MTEF/FSP to both chambers of the national assembly on Tuesday, November 19, 2024.

The MTEF is a multi-year public expenditure plan upon which the budget for a three-year period is set.

READ ALSO: MTEF: What it means and why it matters

Recall also that the House of Representatives presented the report of the joint committee last Wednesday and subsequently passed the MTEF/FSP. However, the senate was unable to attend to the committee’s report last week despite having included it as part of the business of the day on the order paper.

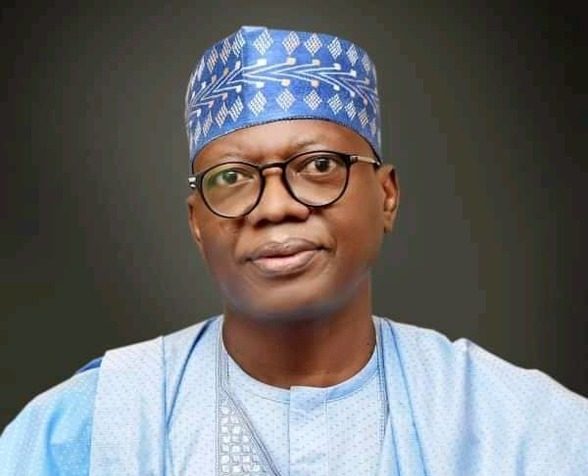

Presenting the report, during the day’s plenary, tchairman of the joint committee, Sen. Sani Musa (APC, Niger East) disclosed that following a thorough review of the submissions presented by the MDAs, the committee noted that some critical agencies such as NNPC, NLNG, Immigration Services and others that are relevant to the attainment of set revenue targets engage in Public Private Partnership (PPP) and Joint Venture (JV) arrangements that are inimical to the revenue growth of the country.

He noted that there is a historical non-remittance of operating surpluses into the federation account by the NNPCL due to what it called under recovery with the claim that the federating units owed it the sum of ₦10 trn.

Sen. Musa lamented that the existing liabilities and debt obligations are largely responsible for increasing debt profile of the country.

He said the committee observed that, “most revenue generating agencies violate the Fiscal Responsibility Act due to the lack of punitive provisions in the Act. It also observed noncompliance with the Nigerian Export Supervision Scheme (NESS) Act by relevant government agencies, specifically focusing on the inspection and monitoring of oil and gas exports as well as non-oil exports.”

He further disclosed that the committee identified systemic gaps and irregularities in the operations of the Import Duty Exemption Certificate (IDEC) and that some federal Ministries Departments and Agencies (MDAs) as well as the Government Owned Enterprises (GOEs) are not complying with the financial reporting standards.

The committee thereafter recommended the following;

1. The projected oil benchmark prices are USD75, USD76.2 and USD75.3 per barrel be approved for 2025, 2026 and 2027 respectively.

2. The three-year projections for domestic crude oil production had a significant increase from 1.78 mbpd in the preceding year to 2.06, 2.10 and 2.35 for the subsequent years of 2025, 2026 and 2027 be approved.

3. That the National Assembly, through its Committees on Finance, National Planning and other relevant Committees should carry out in-depth investigation of such agreements by the NNPC, NLNG and Immigration Services with a view to reconcile remittances to the Federation Account.

4. That the Committees on Finance, Petroleum Upstream, and Petroleum Downstream are tasked to investigate reports from the Revenue Mobilization, Allocation, and Fiscal Responsibility Commission alleging that the NNPC withheld N8.48 trillion as claimed subsidies for petrol. Additionally, the investigation will address the NEITI report stating that NNPC failed to remit $2 billion (#3.6 trillion) in taxes to the Federal Government. The committees are further directed to verify the total cumulative amount of unremitted revenue (under-recovery) from the sale of Premium Motor Spirit (PMS) by the NNPC between 2020 and 2023.

The GDP growth rate which is projected at 4.6%, 4.4% and 5.5% for years 2025, 2026 and 2027 respectively, be approved.

6. The projected exchange rate which stands at NGN1400/USD for years 2025, 2026 and 2027 be approved subject however to review in early 2025 according to monetary and fiscal policies

7. Inflation rates projections which are 15.75%, 14.21% and 10.04% for 2025, 2026 and 2027, be approved.

8. Following the criteria in the overview of the framework for revenues and expenses, the 2025 FGN Budget proposed spending stands at NGN47.9 trillion, of which NGN34.82 trillion was retained; new borrowings stood at NGN9.22 trillion which constitutes both domestic and foreign borrowings; debt service was valued at NGN15.38 trillion; pensions, gratuities and retirees’ benefits stood at NGN1.443 trillion and fiscai deficit at NGN 13.08 trillion.

9. Capital expenditure is projected at NGN16.48 trillion which is exclusive of transfers; statutory transfers stand at NGN4.26 trillion; Sinking Fund is projected at NGN430.27 billion.

10. The Committee approves the respective figures for total recurrent (non-debt) at NGN14.21 trillion; special intervention for recurrent and capital is at NGN200 billion and NGN7 billion.

11. That the National Assembly do approves the Promissory Note Programme and Bond Issuance to settle outstanding claims and liabilities of Federal Government owed to States, high priority judgments as well as liabilities incurred by Federal Ministries, Department and Agencies on behalf of Government.

12. The Committee recommends that a quarterly investigative hearing with revenue generating agencies to track their compliance with the Fiscal Responsibility Act and punish those in clear contravention of the Act.

13. That the Committee on Finance review and initiate inquiry into the implementation of the Nigerian Export Supervision Scheme (NESS) Act, specifically focusing on the inspection and monitoring of oil and gas exports by the Ministry of Finance and the Central Bank of Nigeria (CBN) to ensure effectiveness, compliance, and oversight mechanisms under the Act, identify gaps or challenges, and enhance revenue for the Government, through transparency, accountability and efficiency of export supervision in line with national economic objectives.

14. That the Committees on Finance and Customs to initiate an investigative inquiry into the operations of the Import Duty Exemption Certificate (IDEC) program, with a focus on the administration of import waivers and their impact on revenue losses by the Ministry of Finance and the Nigeria Customs Service, as a way of evaluating compliance, identify systemic gaps or irregularities, and recommend measures to enhance transparency, accountability and optimize revenue generation for the nation.

15. Committee recommends that a performance metrics be established for MDAs with poor financial reporting standards and mandate regular independent audits of their accounts to ensure compliance.

According to Musa the reason why the exchange rate was pegged at N1,400 per United State (US) dollar is to ensure the country has a standard exchange rate and for it to be utilised to service the country’s debt.

He said, “when we put our budget at N1,400, any excess above N1,400 will be utilised to reduce our loan and liabilities.”

Following debates on the report, the President of the Senate, Godswill Akpabio put the bill to a voice vote of which the majority voted in support of its passage.