Nigeria’s growing debt burden has been a subject of concern and a ticking time bomb for generations unborn. The situation calls for urgent redress

The national debt refers to the total amount of money that the government of Nigeria owes its domestic and external creditors. It can be further divided into two: public debts and government accounts debt.

Public debt is the total amount of money owed by the government at all levels to various creditors. It could be treasury bills, bonds or loans while government accounts debt is the debt owed by a government entity to another. The debt is usually within a larger governmental structure and not to external creditors. It could be salaries or procurement.

Debt, GDP and development…

These various debt obligations have adversely affected the nation’s Gross Domestic Product (GDP). GDP is the measure of the total economic output of a country within a specific duration. It includes consumption, investment, government spending and net exports within a given year. It is instrumental for government in making economic policy decisions and help determine a country’s ability to service its debt. A higher GDP generally indicates a stronger economy and more resources to meet debt obligations.

The debt-to-GDP ratio is a common yardstick used to assess a country’s debt sustainability. It compares a country’s total debt to its total economic output, indicating the country’s ability to pay its debts. A high debt-to-GDP ratio is an indication of financial strain while a lower ratio suggests a more manageable debt burden.

Over the years, the debt-to-GDP ratio of Nigeria has fluctuated several times reaching a peak of 75% in 1991, following the adoption of Structural Adjustment Programme (SAP), and a low of 7.3% in 2008, after the Paris club debt relief. Recently, Patience Oniha, the Director General of the Debt Management Office (DMO) revealed that the debt-to-GDP ratio stands at 52%. She made this known during a briefing with media correspondents in Abuja on July 9, 2024. She clarified further that the ratio is still within the specifications of the World Bank and International Monetary Fund (IMF) for the country’s peer group.

In March 2024, the DMO also disclosed that the total public debt was N121.67tn ($91.46bn). This figure is a compilation of the domestic debt set at N65.65trn ($49.35bn) and external debt set at N56.02trn ($42.11bn)

How far can Nigeria go borrowing?

In Nigeria, the national debt is not meant to be inexhaustible. Rather it is supposed to be subject to the debt ceiling, a legal limit on borrowing. The debt ceiling refers to the maximum amount of debt that the government can incur and is determined by the National Assembly of Nigeria. As of February 2023, the debt ceiling was set at 40% of GDP by the National Assembly.

This legal framework sets boundaries on borrowing thereby preventing the country from accumulating debts indefinitely and leading to an unsustainable debt burden for the nation.

Nigeria is currently grappling with a significant debt challenge as the country’s public debt has been on a steady rise, raising concerns about its sustainability and potential impact on the economy. In recent years, the debt has surged dramatically fueled by oil price fluctuations, increased borrowing to finance budget deficits, and debt service costs. Other factors affecting the increase in the debt value include over-dependence on oil revenue, infrastructure deficit, weak revenue generation, corruption and inefficiency.

How did Nigeria’s debt get so high?

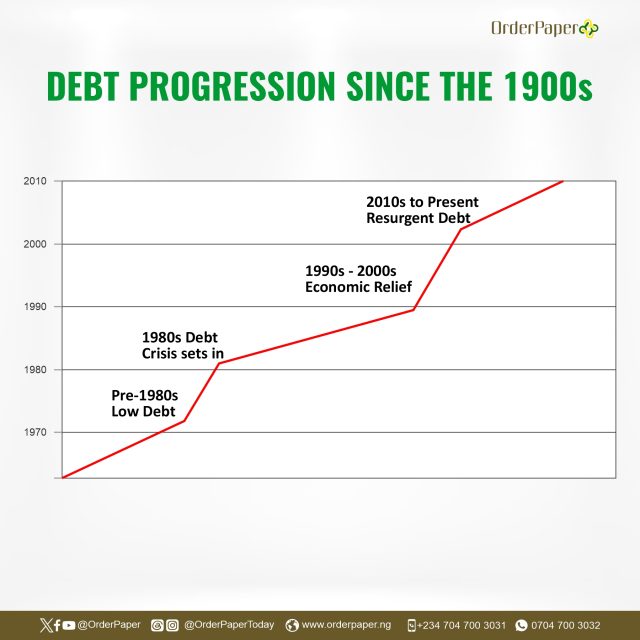

Nigeria did not just get into debt today. The debt history dates way back to the 1980’s and is quite complex and marked by periods of significant growth and decline over the years. There are 4 key eras to consider when examining the debt profile of the country and they are: pre-1980s, 1980s, 1990s – 2000s and 2010s to the present.

Pre-1980s: Era of relative affluence and low debt burden:

In this era, Nigeria experienced a period of stable economic growth fueled by oil revenue. There was a novel economic boom as a result of the discovery and exportation of crude oil. This also provided for diverse significant investment across sectors such as healthcare, infrastructure and education. Consequently, the external debt profile was relatively low and the nation could be said to be economically stable.

1980s: The crisis sets in

By the 1980’s, a decline in oil prices had set in and crude oil earnings was in jeopardy. This unexpected turn of events led the government to resort to frenzied borrowing which resulted in the onset of the debt crisis. The crash in oil prices was due to the sharp decline experienced by the global oil market and this adversely affected the nation as foreign exchange earnings reduced drastically. To cope with the new reality, the government resulted to heavy external borrowing to finance the budget deficits and this set a precedent for the years of debt burden.

With reduced inflow from oil and the resultant excessive borrowing, the economy soon became stagnated leading to a decline in living standards and social unrest across the nation. This economic hardship birthed the implementation of the Structural Adjustment Programme (SAPs). Under pressure from international financial institutions, Nigeria implemented SAP, a series of programmes which involved measures such as privatization, trade liberalization, foreign exchange market reforms, inflation control, fiscal discipline and several austerity measures.

1990s-2000s: Relief and economic recovery

During this period, the debt-to-GDP ratio decreased significantly and Nigeria benefited from debt relief initiatives such as the Paris club of creditors and Heavily Indebted Poor Countries (HIPC) initiatives. The government implemented economic reforms aimed at diversifying the economy and improving governance. Through this, there was a gradual growth in the non-oil sector, reducing dependence on oil revenues.

2010s-Present: A resurgent profile

A sustained increase in public spending on areas such as infrastructure, education, and social welfare programmes coupled with the constant decline in oil revenues culminated in a resurgence of debt. Both domestic and external debt increased and this has constantly given rise to concerns about debt sustainability, management and coping with repayment obligations. Sequentially, the country faced persistent foreign exchange shortages which impacted debt servicing and imports. In a bid to fund the budget deficits, the government resorted to increased domestic borrowing which led to rising interest rates and made an already bad situation worse.

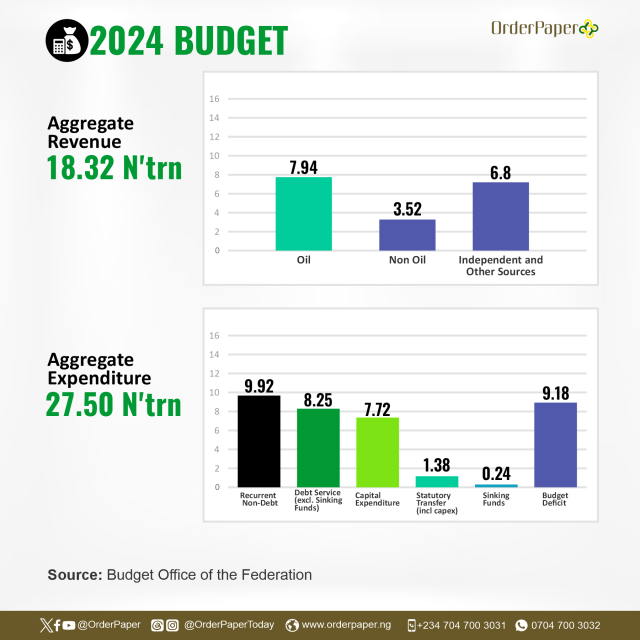

In coping with the rising debt, a large chunk of the national budget is always set aside yearly for debt servicing and for year 2024, that amount is to the tune of N8.25 trn.

Why the rising national debt matters

The increasing debt burden is not without some challenges and after-effects for the country and citizens. Some of these include:

- Constraints on economic growth

Keeping up with the outrageous debt profile can hinder private investment and negatively impact overall economic growth. Private investment is a key driver of long-term economic expansion; therefore, a reduction in such investment stifles economic advancement.

- Limited public spending

As a result of the high debt profile, available funding for essential services is now limited. The high debt service payments are adversely affecting critical parts of the economy thereby creating a setback for the nation.

- Currency depreciation

Increased borrowing can put undue pressure on the naira leading to inflation and making it weaker than it already is. To finance the debt, governments might resort to printing money, which can lead to inflation. In such cases, higher inflation erodes the purchasing power of the currency, leading to depreciation.

- Reduced investor’s confidence

A high debt level can erode investor confidence in the economy making it difficult to retain current investors in the economy or get new ones. It can also portray a deteriorating fiscal outlook, making investors doubtful about a country’s economic stability. This can lead to a decline in foreign investment, depriving the economy a much needed expansion.

READ ALSO: Nigeria’s Monetary Policy Good, Fiscal Reforms Better

The snowball effect…

According to the Nigerian Economic Summit Group [NESG], there are 5 sectors of the economy which can be considered critical based on their linkages with economic growth, other sectors of the economy, provision of employment and social inclusion. These sectors are agriculture, education, health, manufacturing and trade.

Agriculture

As a result of the rising debt situation, private investment on agriculture has reduced drastically and this has sparked a chain of reactions such as the increase in food importation, increased cost of production, a reduction in job creation, research and development. Also, the constant allocation of funds and resources to debt servicing has affected government’s support to the growth of agriculture in the nation. Agricultural subsidies and extension services are no longer readily available and this adversely affected the speed and quality of production in the sector.

Manufacturing

The manufacturing sector has continuously faced several structural challenges which have caused many manufacturing firms to shut down, limiting growth and investment inflows into the sector as well as low sector productivity. Government funding for initiatives supporting the manufacturing sector, such as subsidies and tax incentives have been limited due to the diversion of funds away from investments in manufacturing and this has hindered expansion and modernization. Nigeria now depends heavily on imported inputs as domestic production is not sufficient for demand and this has reduced the sector’s contribution to the GDP.

Healthcare

Debt servicing has affected investment in the healthcare sector. Many of the facilities are in diverse state of ruin and in disrepair due to lack of funding and there has been a limited access to healthcare services particularly for vulnerable populations in rural areas. The lack of attractive pay packages for medical personnel has also led to brain drain as many now prefer to move out of the country at every given opportunity leaving only a handful to attend to the growing numbers of patients. According to the Nigeria Medical Association (NMA), there is currently 1 doctor for every 10,000 patients in Nigeria as opposed to the World Health Organization (WHO) recommendation of 1 doctor for 600 people. The brain drain which began in the mid 1980’s following the introduction of SAP is gradually becoming more rampant today. Additionally, patients are now at the risk of bearing the brunt of increased healthcare costs as they are not as subsidized as before.

Education

In May 2024, the United Nations Children’s Emergency Fund (UNICEF) revealed that the toll of out-of-school children in Nigeria is 18.3 million, with 1 out of every 3 children being out of school. It is quite alarming that the state of education in the country is gradually deteriorating. The reduced government spending on education has led to infrastructure decay, shortage of teachers, and poor learning outcomes. This have also led to an influx of lecturers moving out of the classes for greener pastures outside the nation. The government intervention to public institutions is now at a minimal rate and the fees have skyrocketed making it unbearable for the students and their sponsors.

Trade

The trade sector is the second-largest employer of labour in Nigeria but sadly, there has been impediments to growth of the sector due to activities such as currency devaluation, which has increased the prices of imported goods and services. The lack of adequate funding has also slowed the investment in trade-related infrastructure and initiatives and adversely affected the growth of the sector. This reduced investment in the sector has ultimately made Nigerian goods less competitive in the global market. The yearly debt servicing has also increased Nigeria’s trade deficits as exports have considerably reduced while imports have increased. This has also weakened Nigeria’s negotiating position in trade agreements leading to unfavourable terms during bargain.

READ ALSO: Out of School Children: Reps Seek 4% Allocation for UBEC

Infrastructure is suffering too…

Additionally, the level of infrastructure development in the country is quite disheartening. Gone are the days when the road network was good, power was available constantly and Nigerians could boast of a bearable standard of living. Now is the era of delayed projects, insufficient funds and shoddy jobs. The lack of sufficient funding for critical infrastructure has paved the way for other corrupt practices which have inadvertently hindered economic growth and productivity.

Addressing a perennial burden

To effectively tackle the long-standing debt challenge in Nigeria, several measures need to be put in place and some of these include:

Diversification of the economy: Other sectors of the economy such as manufacturing, agriculture, and services need to be given adequate attention. By expanding the economy, there will be a reduced dependence on oil revenue. Additional revenue can be gotten from these other sources which will help stabilise the economy. Operating a diversified economy reduces vulnerability to sector-specific downturns and helps economic stability.

Improved revenue mobilization: To increase revenue inflow, there needs to be a broadening of the tax base. Tax collection methods need to be improved and there should be adequate measures for combating tax evasion. This will go a long way in harnessing revenue for the government. By expanding the tax base and improving tax collection efficiency, there will be more revenue to work with.

Cutting down costs: Debts can not be reduced or effectively managed if expenses continue to rise. Therefore, the government needs to recognize areas where spending can be reduced without necessarily compromising essential services.

Efficient debt management: The debt burden cannot be sustained if there is no proper management of debt. To achieve this, there needs to be an optimization of the debt structure, reduction of borrowing costs, and strengthening of debt management capacity. Options to restructure or refinance the debt to ease the repayment burden should also be considered.

Stimulating economic growth: Economic growth can be boosted through investment in education, healthcare, and infrastructure. Investing in these areas will create jobs, boost productivity, and increase tax revenue which will ultimately help in combating the debt burden.

Social safety nets: Creating and implementing social safety nets for diverse clusters in the country can protect vulnerable populations during economic downturns and reduce social unrest.

Transparency and accountability: To reduce the borrowing costs and enhance investors confidence, government needs to be transparent in its dealings. A strengthening of institutions, combating corruption, and improving public financial management can enhance investor confidence leading to an increase in economic growth.

Should Nigeria consider debt relief advocacy?

Debt relief refers to the reduction or elimination of part or all of a debt obligation. It can be granted by a creditor or through a legal process, and is often sought by individuals, businesses, or governments struggling to pay their debts. The benefits of debt relief are varied and it include reduced financial stress, improved credit scores, and increased cash flow among others.

Debt relief can be categorised into the following:

- Debt forgiveness: This is a complete elimination of the debt often initiated by the creditor.

- Debt discharge: This is a partial or complete elimination of the debt through bankruptcy or legal proceedings. It is a legal release from debt obligations.

- Debt restructuring: This involves modifying and renegotiating the debt’s terms, such as interest rates or repayment periods which can be reduced or extended respectively.

- Debt consolidation: This is merging multiple debts into a single loan with a lower interest rate and simplified payment.

- Debt settlement: This is usually a negotiation to pay a lump-sum that is less than the original debt amount.

- Debt management plans: This implies working with creditors to create a manageable repayment plan.

Call for a stronger fiscal policy

To combat the ever rising debt, several calls have been made to the government to put policies in place to cushion excessive spending and curb the spread to the national debt. One of such is the call for fiscal reform. The current Fiscal Responsibility Act (FRA 2007) has been under several debates on its effectiveness as the national debt kept piling up despite having a legislation in place.

READ ALSO: ANALYSIS: As Nigeria’s Fiscal Reforms Sets Sail in NASS

The FRA’s objectives include promoting accountability and transparency across ministries and government agencies, maintaining fiscal discipline by ensuring usage of funds align with national priorities, providing guidelines and limits for public borrowing, enhancing coordination and efficiency between government levels, enforcing sanctions and penalties to ensure compliance with its directives. With the effective implementation of the FRA, it is expected to enhance economic stability, improve budget management and reduce national debt.

A ticking time bomb

The increasing debt of the nation calls for grave concerns as it is a ticking time bomb which may explode if proper measures are not put in place. As the debt accumulates, the government pays more money as interest and this depletes the national purse and adversely affects other key areas of the economy which the government might be forced to cater to with more debt thereby creating a larger debt profile with higher risks of unsustainability.

This situation can also create an unfavourable condition for private businesses, leading to a weakening of the private sector and displacing private investments. The underfunding of critical sectors hampers development and has encouraged a brain drain of vital players in sectors such as healthcare, education and agriculture amongst others.

The national debt profile threatens economic growth, social welfare, and overall stability of the national economy. Therefore, this calls for an urgent intervention so as to salvage what’s left of the national resources.