The bank windfall tax introduced by an amendment of the finance act 2023 is eliciting reactions in the country. But while the government jubiliates and the banks hesitate, what does the development portend for the economy as a whole?

The bank windfall tax, a revenue expansion drive by the Nigerian Government, has been the subject of many conversations across the country. Coming on the wake of the huge profits recorded by financial institutions in foreign exchange revaluation gains in 2023, the tax initiative has raised growing concerns and considerable debate regarding its implications for the banking sector, the economy and the citizens.

The scheme is a 70% tax on realised profits made by banks from foreign exchange transactions in the 2023 financial year. It has sparked several discussions particularly because it retroactively affects profits, which banks have already declared and paid taxes on by June 2024.

This move is part of the aggressive plan of President Bola Tinubu’s administration to raise the share of tax revenue of Gross Domestic Product (GDP) from 11 per cent to 18 per cent within three years. The constant depreciation of the naira has made assets held by banks in foreign currencies to skyrocket in value, a development the Nigerian government has welcomed with the bank windfall tax.

Why the bank windfall tax?

In the wake of the newly approved minimum wage of N70,000, the government decided to amend the finance act to allow the introduction of a windfall tax on banks. It is also a move to source for more funds to drive the economy and augment government spending plans. Last week, President Tinubu wrote to the National Assembly, asking for an amendment to the finance act 2023. According to the president, the tax will help fund capital infrastructural development, education and healthcare access as well as public welfare initiatives all of which are essential components of the renewed hope agenda. The one-time windfall tax on banks’ foreign exchange profits is also expected to finance the additional N6.2 trillion contained in the appropriation (amendment) bill submitted alongside the finance bill. With the imposition of the windfall tax, the government hopes it could help cut public debt as a share of GDP from 71.4 per cent in 2022/2023 to 69 per cent by 2024/2025.

Banks and windfall profits

Hitherto, Nigerian banks had declared mega-profits for the year 2023 and the first quarter of 2024. In 2023, four first-tier banks – Access Holding, GTCO, UBA, and Zenith Bank- grew their gross earnings by 114.40 per cent to N7. 98tn. Consequently, their cumulative pre-tax profit rose 233 per cent to N2.89tn. Below is a breakdown of Access Holding, GTCO, UBA, and Zenith Bank Turnover for 2023 (Source: published financial statements of the banks for 2023)

| S/N | BANK | GROSS EARNINGS | PRE-TAX PROFIT |

| 1. | Zenith | 2.132trn | 795.96bn |

| 2. | UBA | 2.08trn | 757.68bn |

| 3. | Access Holdings | 2.59trn | 729bn |

| 4. | GTCO | 1.187trn | 609.3bn |

| TOTAL ~ | 7.98trn | 2.89trn | |

What the finance act amendment says

The finance act (amendment) bill proposed to impose a one-time 50% windfall tax on the foreign exchange gains realised by banks in their 2023 financial statements. This is reflected in section 30 of the bill which says “there shall be levied and paid to the benefit of the Federal Government of Nigeria a tax of 50% on the realised profits from all foreign exchange transactions of banks within the 2023 financial year.” To show the seriousness of the matter, section 32, sub-section 2 listed sanctions to be imposed on defaulting banks. It says: “Any bank that fails to pay the windfall tax to the (Federal Inland Revenue) Service and has not executed a deferred payment agreement before 31st December 2024, commits an offence and shall, upon conviction, be liable to pay the tax withheld or not remitted in addition to a penalty of 10 percent of the tax withheld or not remitted per annum and interest at the prevailing Central Bank of Nigeria minimum rediscount rate and imprisonment of its principal officers for a period of not more than three years”.

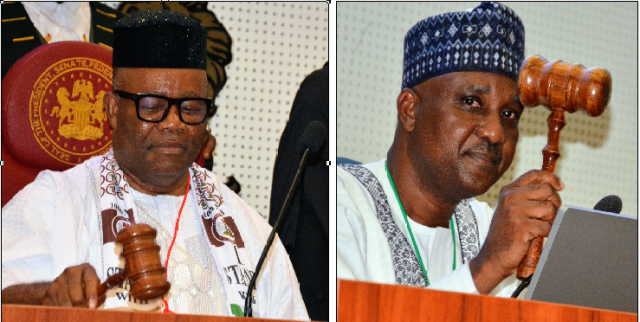

National assembly’s hurried response

Apart from speedily passing the bill, the national assembly raised the windfall tax from 50% to 70%. The argument of the lawmakers is that the windfall was not a result of any effort of the banks or value addition, but as a result of government policy and so must be redistributed.

In addition, the lawmakers also removed the sanction of jail term for principal officers of defaulting banks but retained the fine of 10% of the levy withheld or not remitted per annum and interest at the prevailing Central Bank of Nigeria (CBN) Minimum Rediscount Rate (MMR).

It is worth noting that the finance bill was expeditiously passed by the National Assembly. In less than a week after the executive bill was communicated, both chambers of the federal legislature sped through the minimum of six processes of passing a bill to enact the amendment. The bill was transmitted to both the senate and house of representatives on the 17th of July, 2024. It went through first and second reading same day and was refered to the committee on finance and appropriation. It was eventually passed on the 23rd of July, 2024 even though there was no record of a public hearing conducted where stakeholders are expected to air their views on the bill.

READ ALSO: Minister gives details of N6.2trn extra budget for 2024

Windfall tax in other countries

Windfall tax receipts has helped several other countries such as France, Sweden and Czech to boost their economy and the Nigerian Government might have taken a cue from these countries.

In July 2023, the United Kingdom introduced a temporary windfall tax on the profits of banks and insurance companies. This tax was designed to help generate funds to support households struggling with the cost-of-living crisis.

Earlier in 2013, South Africa also introduced laws that allowed for the taxation of fair value adjustments on certain financial assets and liabilities held by brokers and banks. The revenue generated from these payments helped with government spending and repair of public sector infrastructures.

What the tax means for the banking sector

Concerns have been raised in some quarters that the windfall tax is coming at a time of renewed pressure on banks to broaden their capital base. On March 28, 2024, the Central Bank of Nigeria (CBN) announced a bank recapitalization programme wherein it increased the minimum capital requirements for banks in Nigeria in a bid to strengthen their asset base and support economic growth. This is also part of the apex bank’s efforts to strengthen their capacity to support Nigeria’s drive to become a $1trn economy by 2026.

In a memo to the banks, the apex bank set new capital bandwidth thus: international operations – N500 billion, national licence- N200 billion, and regional licences- N50 billion. This is a huge leap away from the current threshold of N50bn, N25bn, and N10bn, respectively.

This directive, a crucial step towards a stronger banking sector, initiates a time-sensitive two-year journey that started on April 1, 2024, and would end on March 31, 2026. To meet these requirements, banks must explore options such as capital raises, mergers and acquisitions, or downgrading license authorizations within the stipulated timeframe.

Apart from the windfall tax pressure, it is worth noting that banks currently pay several taxes such as Company Income Tax (CIT), Value Added Tax (VAT), Educational Tax, Capital Gains Tax, Withholding Tax, and NITDA Levy amongst others. Adding the windfall tax to these existing taxes especially during this phase of recapitalization poses several implications which may include the following:

- Reduced profitability: Imposing the windfall tax may significantly reduce banks’ profits, and ultimately affect their ability to provide for loans and also transfer funds to retained earnings, which is a crucial aspect of regulatory capital.

- Negative impact on capital adequacy: The tax will particularly affect banks with capital adequacy close to regulatory thresholds, potentially leading to reduced lending capacity.

- Unpredictability and investor confidence: The retrospective application of the tax and lack of clarity on its implementation may deter investors and affect confidence in the financial markets.

- Impact on economic growth: The tax may affect banks’ ability to support economic growth. The reduced profitability and capital adequacy can also lead to decreased lending and investment.

What windfall tax means for the public

Asides from the banks, the windfall tax will also have potential benefits and drawbacks on the general populace.

-

Potential Benefits

Increased public spending: With the revenue to be realised from the windfall tax, the government could invest in more public infrastructure, improved education system, and refined healthcare. Investing in these areas would improve the quality of life for many Nigerians.

Reduced debt: The revenue could also be used to settle some of the public debt thereby freeing up funds for future investments.

-

Potential Drawbacks

Higher bank charges: To offset the tax and oblige the government, banks may try to raise interest rates on loans or lower interest rates on deposits. Any of these options will disproportionately affect low-income Nigerians who depend on bank services. Prior to the introduction of the windfall tax, Nigerian banks have been in the habit of imposing excessive bank charges and illegal deductions on their customers. The National Assembly has had to investigate this disturbing practice several times in the past. However, the implementation of the windfall tax may lead to more fleecing of bank customers.

Reduced access to credit: Banks might become more cautious about lending if their profits are continually squeezed. This makes it harder for businesses and individuals to borrow money.

What the tax means for the economy

Here are some of the potential impacts the windfall tax will have on the economy.

-

Potential Benefits

Short-term revenue boost: The tax could provide the government with a significant amount of money in the short term.

Investment in infrastructure: The revenue could be used to invest in infrastructure projects that could stimulate economic growth in the long run.

-

Potential Drawbacks

Discourages investment: The tax could discourage banks and other businesses from investing in Nigeria, harming economic growth in the long run.

Market uncertainty: The controversy surrounding the tax could create uncertainty in the financial markets, making businesses hesitant to invest.

Reduced bank profitability: If banks are forced to pay a large chunk of their profits in tax, they may have less money available to lend to businesses and individuals. This could slow economic activity.

Stakeholders raise opposition

The windfall tax has met stiff opposition from bank shareholders. and there could be legal actions against the directive in court.

In a commentary released by KPMG, a lack of transparency in the tax implementation process was flagged. “Lack of transparency has been the bane of policy formulation in the country. It is always important that the public be presented with tax expenditure statement showing how much will be generated from the introduction of a new tax. It will also afford the public the opportunity to review the reasonableness of the assumptions underpinning the revenue target”

Further describing the tax as a retrogressive move, KPMG revealed that“Nigeria’s tax policy frowns at retroactive application of tax laws. It is, therefore, surprising, that the government has chosen to implement these windfall taxes retroactively. Moreover, many of these banks have submitted their tax returns for the 2023 financial years and have settled the resultant liability.” It therefore suggested the introduction of tax relief alongside the new policy to cushion the impact of the windfall tax on banks.

Weighing in on the situation, Head of Equities Research, West Africa, Standard Bank Group Securities, Muyiwa Oni, revealed that the tax might cost banks over N200bn. “Based on our analysis, we ended up with about N200bn, but it could be more if there is further disclosure to show that there are other foreign currency related income as well.” he said while speaking to an online medium.

A group, New Dimension Shareholders Association (NDSA), has also strongly opposed the windfall tax. President of the New Dimension Shareholders Association [NDSA], Mr Patrick Ajudua, who spoke with an online medium, described the action of government as an unfair and immoral act. He argued that the tax would unjustifiably undermine the financial performance of banks in a challenging operating environment and significantly reduce shareholders’ funds. He maintained that the forex gains resulted from the devaluation of the naira and did not involve actual cash movement, citing previous CBN circulars instructing banks not to pay dividends from these gains. Ajudua warned that shareholders would take legal action if the government continued its pursuit of the tax policy. “Government must look for other ways to improve or finance their expenditure. The thought of using such funds to finance infrastructural development doesn’t hold water, and the same reason was adduced to attempt to use the pension fund,” he said.

Government remains adamant

On the contrary, the federal government has maintained that the tax is right and justifiable. Wale Edun, minister of finance described the tax as an important contribution to the government’s revenue. “The bank windfall profit levy, although small, still constitutes an important contribution to government finances at a time when revenues have substantially increased despite minimising taxes,” he said during his appearance before the National Assembly joint committee on finance to defend the windfall tax.

What lies ahead?

With recent happenings, the Nigerian stock market has seen a decline, most especially in the banking sector. Analysts fear that the implementation of the tax will discourage investment and hamper the growth of the financial sector.

These policy shifts have also been linked to the exit of various businesses. Some economic reforms by the government have been pushing many businesses, especially the import-dependent ones to the verge of collapse. Some multinationals have shut down their Nigerian outlets and stopped all operations.

In the coming days, the tax could adversely impact financial inclusion by limiting banks’ ability to expand financial services to underserved populations. It could also overburden the banks which may lead to consolidation in the banking sector. The retroactive nature of the tax may create uncertainty and perceived instability, making Nigeria a less attractive destination for investment.