The NANS president called for a review of the time frame for payment from 2 years to at least 4 years as 2 years is too short for payment of a loan after graduation.

The President of the National Association of Nigerian Students (NANS), Usman Barambu, has called on the House of Representatives to amend the Student Loan Act to enable all Nigerian Students, who desire loans to access them.

This is as it appealed for the inclusion of the student body on the Committee Board so as to capture Polytechnics and Colleges of Education bodies instead of only the National University Commission (NUC), which was earlier captured in the Student Loan Act of 2023.

Barambu also called for a review of the method of payment as well as the time frame from the 2 years stipulated in the Act, to at least 4 to 5 years, adding that 2 years was too short for payment of loan after graduation.

Speaking at the legislative summit on student loans and access to higher education held by the ad-hoc committee on Thursday in Abuja, Barambu said the criteria for access to loans in the current Act was too stringent.

He also complained that the list of guarantors as part of the condition for students to access the loan should be looked into, as most students will be unable to meet the guarantors’ requirements.

he said, “Student loan is for us. And, no student representation is on the board. The board only captured NUC, sidelining polytechnics and colleges of education; they should all be inclusive for fairness and equity.

“Also, the method of payment should be looked into as most students are not able to find their ground financially two years after graduation. It should be revised to 4 to 5 years. The Act also gives no room for forgiveness in cases of death especially, for security officers. That should also be looked into.”

READ ALSO: Legislative Agenda: Stakeholders urge Reps to probe N150bn PTF

Also speaking at the summit, the Registrar of the Joint Admission and Matriculation Board (JAMB), Professor Ishaq Oloyede, who was represented, noted that Student loans represent a turning point in the history of higher education in Nigeria, in the 21st century.

Oloyede tasked the lawmakers with looking at the feasibility of the loan covering other areas and stressed the need to review the Act to cover the cost of other things beyond school fees as students now pay more for accommodation, feeding, and transportation.

while calling for measures that would guarantee its sustenance, JAMB also canvassed the development of a conducive environment for the repayment of the loan even as it noted that the Act should be calibrated to factor in market instability, inflation pandemics, and force major.

In his contribution, the Chairman, Federal Inland Revenue Service (FIRS) Muhammad Nami, said that the FIRS is committed to working with the parliament on the students’ loans project, adding that as soon as the mandate is given, funding will be made available.

Nami however, expressed concern over the 1% federal government revenue meant for the funding, and suggested that, rather than federal allocation only, the parliament should seek an amendment that will allow the funding to be drawn from a federation account, where all States can contribute too.

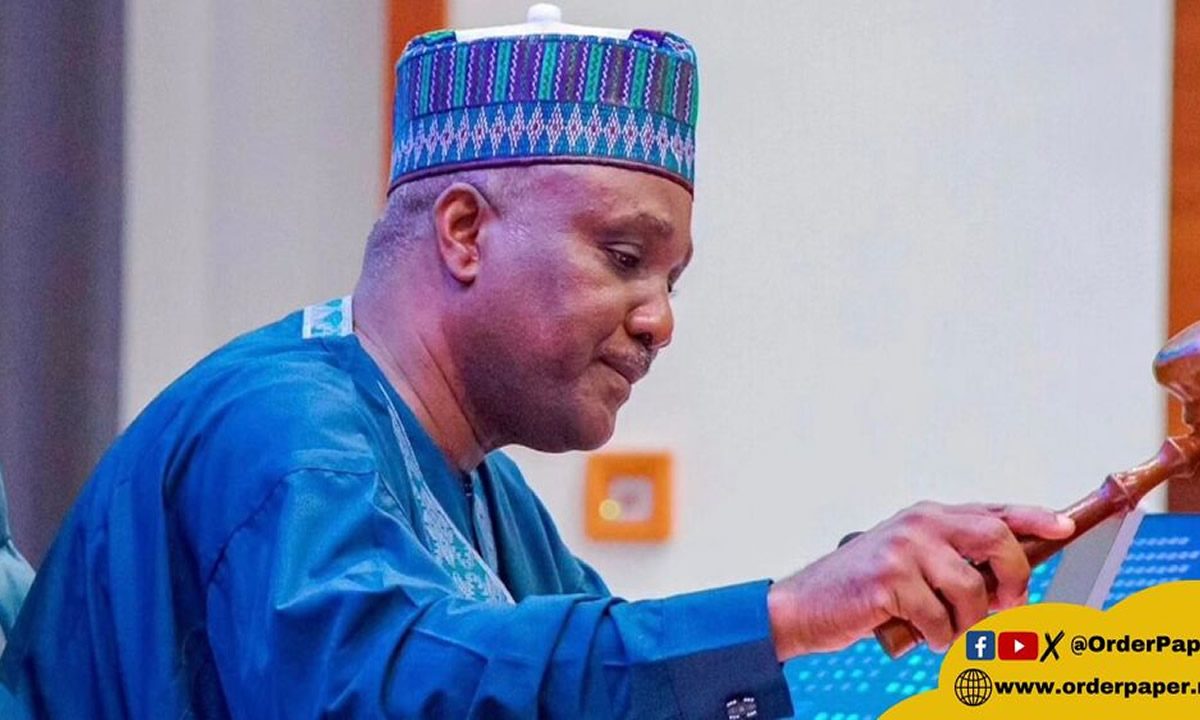

Speaking earlier, the Deputy Speaker of the House, Rep. Benjamin Kalu, said that the summit was aimed at addressing the issues emanating from the Student Loan Act 2023 – a law that promotes more equitable access to quality higher education for our children.

Kalu noted that education is integral to the development of any nation, and no country can afford to toy with the future of its young people.

“The legislature, as you know, plays a crucial role in providing access to quality education in the country. Our role in this regard is multifaceted. It involves enacting laws and policies that govern education, allocating resources, and overseeing the implementation of these policies and laws as well as the utilization of appropriated funds.

“Through these actions, the legislature contributes significantly to creating an enabling environment for quality education and ensuring that the right to education is upheld for all Nigerians. In this respect, the Student Loan Act is a transformational piece of legislation.

“This is quite critical given that education is considered a fundamental right in Nigeria. The legislature as custodians and defenders of citizens’ rights, play an essential role in safeguarding this right. This informed the initiation and passage of the Student Loan Act by the 9th House of Representatives.

“The purpose was to create seamless access to credit facilities for quality higher education. The legislation finds its relevance in the recognition that one of the key barriers to accessing higher education is the high cost associated with tuition fees, accommodation, textbooks, and other educational expenses.

“Many talented and deserving students are unable to afford these costs, leading to a significant disparity in educational opportunities. As a result, we are witnessing a situation where only a privileged few can access quality higher education while the majority struggle to make ends meet contrarily, we cannot afford to have the majority of our citizens uneducated.

“The Student Loan Act is a legislative framework designed to address the financial challenges faced by young Nigerians to accessing higher-quality education. By accessing credit facilities, the Act aims to ensure that deserving students are not denied educational opportunities due to financial constraints.

He said however, concerns have been raised about the conditions for accessing the loan as contained in the Act, hence the need for a review.

“It is feared that these conditions might hamper the good intentions of the legislature, which is to create access for as many Nigerians as possible who desire quality higher education. It is due to this fact that the summit was convened to harness the opinions of stakeholders and experts on the improvement of the Act,” he added.

In his closing remarks, the chairman of the Ad-hoc Committee on Students Loans and Access to Higher Education, Rep. Terseer Ubor (APC, Benue), assured stakeholders that all submissions made will be aggregated and looked into and recommendations will be made available before the general House.