On Thursday, the House of Reps engaged consultations on constitution review and thorny issues on the controversial tax bills

Reps to seek further consultations on tax bills

After about two hours of a closed door session, the House of Representatives has resolved to seek further consultation on President Bola Tinubu’s tax reform bills.

It also disclosed that resource persons will be invited to a special session next Tuesday to enlighten lawmakers on the possible benefits of the proposed legislation to Nigeria’s economy and what every part of the country stands to gain from the tax reforms.

This was revealed by the Deputy Speaker Rep. Benjamin Kalu (APC Abia) who presided over the session Thursday. He admonished the members to get more understanding on the tax bills ahead of next week.

ALSO READ: House of Reps confirm Oluyede as chief of army staff

Constitution Review committee roll out priorities

The Deputy Speaker of the House of Representatives and Chairman of the House Committee on Constitution Review, Rep. Benjamin Kalu (APC Abia), stated on Thursday that the ongoing constitutional review by the parliament is focused on improving the functionality of local governments, the judiciary, electoral processes, and security.

Speaking during a meeting of the House Constitution Review Committee, Kalu also highlighted other critical areas of focus, including the devolution of power, gender equality, revenue and fiscal reforms, and human rights.

It was also revealed at the meeting that the public hearing on constitutional review will commence January 2025 and will be conducted from two states in six geopolitical zones of Nigeria. Niger and Nasarawa for North Central, Kaduna and Sokoto for North West, Gombe and Borno for North East, Bayelsa and Cross River for South South, Enugu and Imo for South East and Lagos and Ondo for South West.

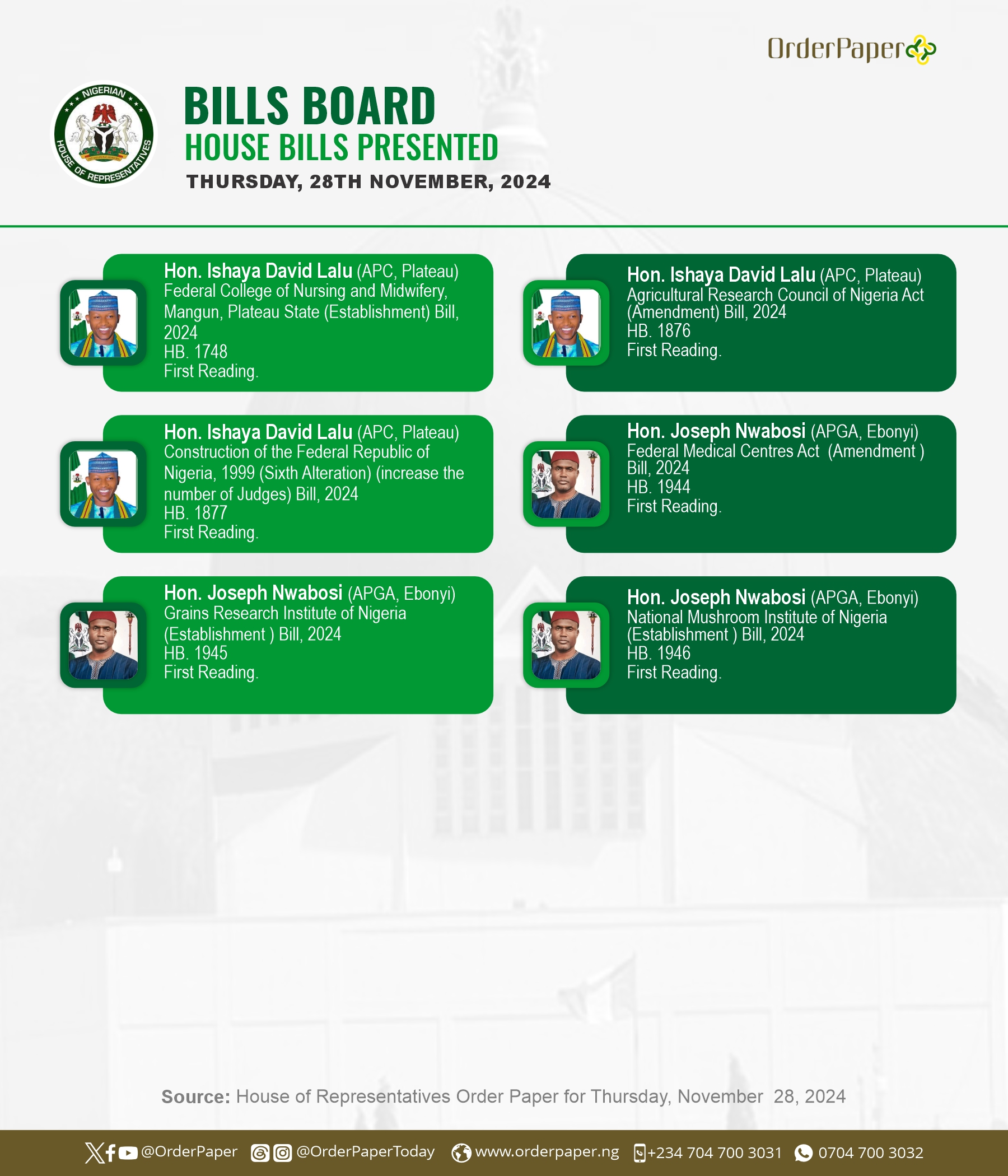

BILLS CHART FOR THE DAY

Below is OrderPaper’s signature presentation of bills taken in the House plenary today. Readers are invited to contact us for further information via info@orderpaper.ng or WhatsApp via +234 704 700 3031